Loading

Get Pwe Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pwe Form online

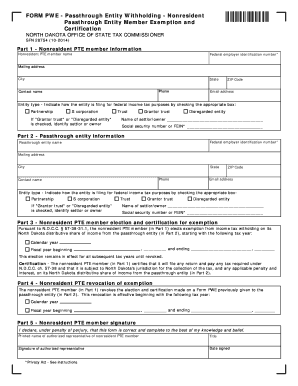

The Pwe Form is essential for nonresident passthrough entity members to elect exemption from North Dakota income tax withholding. This guide will help you navigate the form’s components easily and accurately, ensuring you meet all necessary requirements.

Follow the steps to complete the Pwe Form effectively.

- Click ‘Get Form’ button to access the Pwe Form. This action will allow you to obtain the document and open it for editing.

- In Part 1, provide the nonresident PTE member's information, including their name, federal employer identification number, mailing address, contact details, and entity type. Be sure to check the correct box for how the entity is filing for federal income tax purposes.

- Complete Part 2 with the passthrough entity’s information. This includes their name, federal employer identification number, mailing address, and contact details. Again, select the appropriate entity type by checking the corresponding box.

- In Part 3, you will elect exemption from income tax withholding. Indicate the tax year this exemption should commence by specifying either a calendar or fiscal year, and remember that this election remains in effect until revoked.

- If you wish to revoke a previously granted exemption, complete Part 4. Specify the effective date for the revocation by filling in the tax year.

- In Part 5, the authorized representative must provide their printed name, title, signature, and the date signed, affirming that the information is correct and complete.

- Once all sections are thoroughly filled out, you can save your changes, download the completed form, print it, and share it as required.

Complete your Pwe Form online today to ensure timely submission and compliance.

§ 57-38-31.1, a passthrough entity is required to withhold North Dakota income tax at the rate of 2.90% from a nonresident member's North Dakota distributive share of income if (1) it is $1,000 or more and (2) it is not included in a composite return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.