Loading

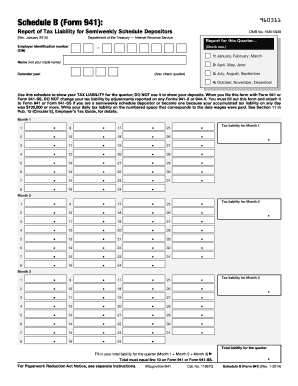

Get Fillable 941 Schedule B

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable 941 Schedule B online

Filling out the Fillable 941 Schedule B is an essential process for reporting your tax liabilities as a semiweekly schedule depositor. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the Fillable 941 Schedule B online

- Press the ‘Get Form’ button to access the Fillable 941 Schedule B form and open it in your preferred digital editor.

- Begin by entering your employer identification number (EIN) at the top of the form. This unique identifier is crucial for your tax filings.

- Indicate the reporting quarter by checking the appropriate box—January to March, April to June, July to September, or October to December.

- Fill in your name in the designated area. Note that this should be your actual name and not your trade name.

- For each month of the quarter, you will need to fill out the tax liability for each applicable date. Write down the daily tax liability corresponding to the date when wages were paid.

- At the end of the month sections, calculate the total tax liability for each month. This is necessary for reporting your total accurately.

- Once you have entered the total liabilities for Month 1, Month 2, and Month 3, sum these amounts to get your total liability for the quarter.

- Ensure that the total liability you calculated matches line 10 on Form 941 or Form 941-SS to maintain consistency and avoid discrepancies.

- After entering all necessary information, review the form for accuracy and completeness.

- Finally, you can save your changes, download a copy of the completed form, print it for your records, or share it with relevant parties as needed.

Complete your documents online today for a smooth filing experience.

Related links form

File your amended Schedule B with Form 941-X. The total liability for the quarter reported on your amended Schedule B must equal the corrected amount of tax reported on Form 941-X. If your penalty is decreased, the IRS will include the penalty decrease with your tax decrease.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.