Loading

Get General Forbearance Request

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

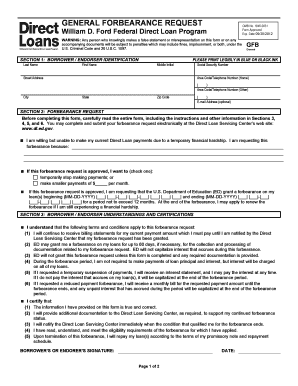

How to fill out the GENERAL FORBEARANCE REQUEST online

This guide provides a comprehensive overview of how to complete the General Forbearance Request online. Follow these step-by-step instructions to ensure that you fill in the necessary information accurately and effectively.

Follow the steps to successfully complete your request.

- Click ‘Get Form’ button to access the General Forbearance Request. This will allow you to open the form in your preferred editor.

- In Section 1, provide your personal information including your last name, first name, middle initial, street address, and Social Security Number. Ensure all information is correct and clearly printed.

- Continue in Section 1 by including your home and alternate telephone numbers, city, state, zip code, and an email address if you choose to provide one.

- In Section 2, indicate your reason for requesting forbearance due to temporary financial hardship. Check the appropriate box for either temporarily stopping payments or making smaller payments.

- Specify the requested forbearance period by providing start and end dates in MM-DD-YYYY format. Ensure this period does not exceed 12 months.

- Read through Section 3 regarding the understandings and certifications. Confirm that you understand the terms and conditions and check all required statements.

- Sign and date the form in the designated space of Section 3. Ensure that your signature is legible and matches your printed name.

- Review the completed form for accuracy, ensuring that all sections are filled out appropriately.

- Send the completed form along with any required documentation to Firstmark Services using the provided address or fax number. Alternatively, you can save, download, or print the form for your records.

Begin completing your General Forbearance Request online today for assistance with your financial obligations.

Related links form

They're a combination that can sink personal finances and credit scores for years. Forbearance can also benefit lenders. ... If a borrower can get back on track with forbearance, that's best for them and the lender. And though it's not great, forbearance is at least better than a foreclosure.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.