Loading

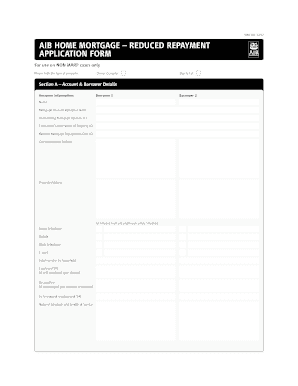

Get Aib Home Mortgage Reduced Repayment Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AIB Home Mortgage Reduced Repayment Application Form online

Filling out the AIB Home Mortgage Reduced Repayment Application Form online can seem daunting, but this guide will help you navigate through each section with ease. By following these steps, you can ensure that all required information is accurately provided.

Follow the steps to complete your application smoothly.

- Click 'Get Form' button to obtain the form and open it in your preferred document viewer.

- Begin filling out Section A – Account & Borrower Details. Here, you will provide information for Borrower 1 and Borrower 2, including names, mortgage account reference numbers, outstanding mortgage balances, estimated property values, monthly repayments due, correspondence addresses, and preferred contact methods.

- Continue to Section B where you will list information about any properties owned, including the address, type of property, ownership type, loan balances, arrears balances, monthly rental income, monthly expenditure, and status regarding restructuring or sales.

- In Section C, provide details of your monthly income for Borrower 1 and Borrower 2, including gross and net monthly salaries, social welfare benefits, child benefits, and any other income sources. Add details about any savings, investments, or other assets.

- Proceed to Section D to outline your monthly household expenditures. This may include utilities, household needs, transport, mortgage-related costs, education expenses, medical expenses, social costs, savings, and any other monthly expenditures.

- In Section E, document your financial commitments, such as lenders, the purpose of borrowing, outstanding balance, repayment terms, and expiry dates.

- Section F requires you to state the reason for your request, outlining any proposals for the home loan account, including preferred reduced repayment methods.

- Finally, read the declaration carefully, providing your consent to the use of your information as stated. After reviewing all sections, confirm your information is accurate, and sign the form.

- Save your changes, then download, print, or share the completed form as needed.

Complete your AIB Home Mortgage Reduced Repayment Application Form online today to take the next step towards your financial goals.

The general rule is that if you double your required payment, you will pay your 30-year fixed rate loan off in less than ten years. A $100,000 mortgage with a 6 percent interest rate requires a payment of $599.55 for 30 years. If you double the payment, the loan is paid off in 109 months, or nine years and one month.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.