Loading

Get 2012 Form Gr-1041 Instructions 12262012.docx. 2012 Michigan Adjustments Of Capital Gains And Losses

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Form GR-1041 Instructions 12262012.docx. 2012 Michigan Adjustments Of Capital Gains And Losses online

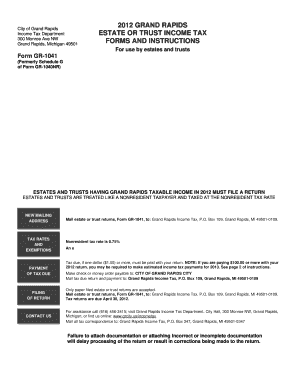

This guide provides comprehensive step-by-step instructions on how to complete the 2012 Form GR-1041, which pertains to adjustments of capital gains and losses for estates and trusts in Michigan. By following these directions, users can ensure that their forms are accurately filled out and submitted without errors.

Follow the steps to fill out the 2012 Form GR-1041 effectively.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Identify the tax year of the estate or trust. Enter the relevant time period in the designated fields.

- Complete the identifying information of the estate or trust, including the name, address, and federal employer identification number.

- For Line 1, report the net business income or loss. Attach the necessary federal Schedule C to support this entry.

- For Line 2, indicate the capital gain or loss, ensuring to attach federal Schedule D as appropriate.

- Line 3 requires reporting income from rental activities, partnering agreements, or other trusts; attach Schedule E to document this.

- For Line 4, report any farm income or loss, attaching Schedule F if applicable.

- Report ordinary gains or losses on Line 5, including copies of federal Form 4797 as documentation.

- List any other income earned on Line 6, ensuring to provide the necessary backup documentation.

- Calculate total income by adding Lines 1 through 6 and enter the result on Line 7.

- Complete lines for Renaissance Zone deductions as necessary, entering results on Line 8.

- Prepare detailed exclusion and adjustment schedules for all applicable lines — Schedules 1 through 6 — and ensure they are attached.

- Make sure to calculate the tax due and carefully enter it on the designated line, including any payments made.

- Finally, review the entire form for accuracy, save your changes, and prepare for printing or sharing as required.

Complete your 2012 Form GR-1041 online for accurate tax reporting and timely submissions.

Enter short-term capital gain distributions on Screen Income, located under the Income (inc) folder. The amount(s) should also be entered within the Dividends statement dialog, as they are reported on Form 1099-DIV, in order for the short-term gains to be considered in Accounting Income (AI).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.