Loading

Get 25.25 Correction Request For Personal Property - Brazoria County ... - Brazoriacad

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 25.25 Correction Request For Personal Property - Brazoria County online

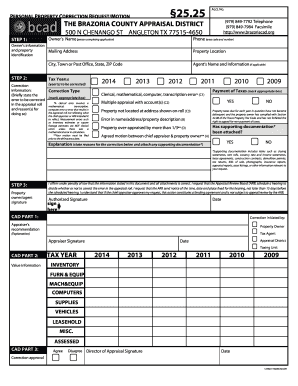

The 25.25 Correction Request for Personal Property is a critical document for users seeking to correct errors related to property appraisal in Brazoria County. This guide will walk you through the steps to fill out the form online accurately and efficiently.

Follow the steps to fill out the form carefully.

- Press the ‘Get Form’ button to access the correction request form and begin filling it out in the available online editor.

- In the 'Owner's Name' section, provide the full name of the person completing the application. Next, enter their phone number, including the area code.

- Fill in the 'Mailing Address' section with your complete mailing address, including city, state, and ZIP code. This identifies where correspondence regarding the request should be sent.

- Specify the 'Tax Year(s)' that you believe require correction by entering the relevant years in the designated field.

- Indicate the 'Correction Type' by selecting the appropriate boxes for any errors that apply, such as clerical, mathematical, or property over-appraised. Provide a brief but clear explanation of the error in the space provided.

- If applicable, enter the 'Agent's Name and Information' if you are submitting the request through a tax agent.

- Confirm whether taxes for each indicated year are paid by clicking 'YES' or 'NO.' Pay attention to the requirement that taxes must not be delinquent to process the correction.

- Attach any required supporting documentation that justifies your correction request, as indicated in the form. This may include photographs, tax returns, or relevant agreements.

- Sign the document in the 'Property Owner/Agent Signature' section, affirming that all information is accurate to the best of your knowledge.

- Indicate the date of signing and ensure you check all information for completeness before submitting the form.

- Once all fields are complete, you can save changes, download the completed form, print it for your records, or share it as needed.

Complete your 25.25 correction request form online today to ensure accurate property appraisals.

Related links form

To protest an appraisal value set by BCAD, a taxpayer must notify the Appraisal District by May 15 or 30 days from the date of the Notice of Appraised Value. If no Notice of Appraised Value was generated by the Appraisal District, a protest may still be filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.