Loading

Get Form It-201-x-i:2014:instructions For Form It-201-x Amended Resident Income Tax Return:it201xi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form IT-201-X-I:2014:Instructions For Form IT-201-X Amended Resident Income Tax Return:IT201XI online

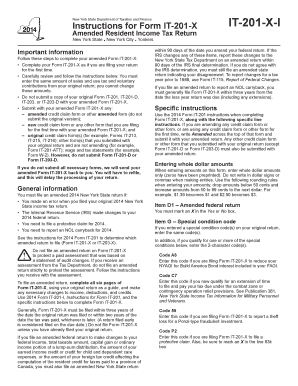

Filing an amended tax return can be straightforward when you follow the right steps. This guide will help you understand how to complete the Form IT-201-X-I:2014 online, ensuring you provide all necessary information accurately.

Follow the steps to successfully complete your amended tax return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete your Form IT-201-X as if you are filing for the first time. Refer to your original return to ensure accuracy in the information you are amending.

- Mark an X in the Yes or No box for Item D1, indicating whether you have also filed an amended federal return.

- If you had special condition codes on your original return, be sure to enter those same codes in Item G along with any new codes if applicable.

- Report your standard or itemized deductions accurately in Line 34, ensuring you are consistent with your original filing unless amending those amounts.

- For Line 59, enter the exact amount of sales or use tax reported on your original return, as this amount cannot be modified.

- Enter the voluntary contributions from your original return in Line 60, ensuring that no changes are made to these amounts.

- Calculate your refund on Line 80 based on the differences between your amended amounts, and choose how you wish to receive this refund.

- If applicable, provide details for direct deposit or check refund, including the required bank account information in Line 82.

- Prepare and submit any necessary supporting documents with the form to avoid delays in processing, ensuring they are clearly labeled for the purpose of your amendment.

- Review all entries before finalizing. Once complete, save your changes, download a copy of the amended return, and print or share it as needed.

Begin your tax amendment process by filling out the Form IT-201-X online today.

What is form it-201 for? Form IT-201 is the standard New York income tax return for state residents. Nonresidents and part-time residents must use must use Form IT-203 instead. Form IT-201 requires you to list multiple forms of income, such as wages, interest, or alimony .

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.