Loading

Get Spen Chalan Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Spen Chalan Form online

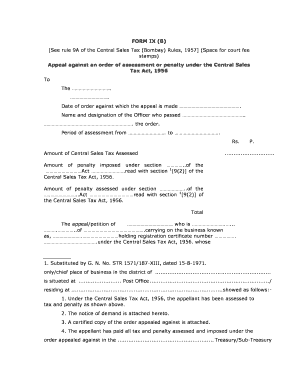

Filling out the Spen Chalan Form is a crucial step in filing appeals against orders of assessment or penalties under the Central Sales Tax Act. This guide provides clear, step-by-step instructions to help you navigate the form successfully, ensuring that you provide the necessary information accurately.

Follow the steps to complete your Spen Chalan Form online.

- Press the ‘Get Form’ button to access the Spen Chalan Form and open it in your digital editor.

- Begin by filling in the details of the authority you are addressing. Enter the name of the officer or department handling your appeal in the designated space.

- Provide the date of the order you are appealing against. This is essential for establishing the timeline related to your case.

- In the next section, fill in the name and designation of the officer who issued the original order against which you are filing the appeal.

- Specify the period of assessment by entering the starting and ending dates in the respective fields.

- Indicate the amount of Central Sales Tax assessed in the designated space, followed by the penalty amount imposed under the applicable section of the Act.

- Fill in the total amount, which includes both the assessed tax and any penalties.

- Clearly state your name and your role (such as partner, owner, etc.) within your business enterprise, along with the registration certificate number under the Central Sales Tax Act.

- Attach relevant documents, such as the notice of demand and a certified copy of the order you are appealing against.

- Provide details about your tax payments, including the treasury or sub-treasury where payments were made and the respective challan number and date.

- Enter a summary of your turnover of inter-State sales during the specified period, ensuring to indicate that these sales are the entirety of your inter-State transactions.

- Document the calculations for any Central Sales Tax payable and the penalties applicable during the designated timeframe.

- Assert that you have complied with all the necessary tax return filings and any demands from the relevant authority.

- Articulate the grounds for your appeal clearly in the designated section.

- Finally, conclude with your prayer for the desired outcome of the appeal and sign the document, either personally or via an authorized agent.

- Review all entries for accuracy and completeness before saving your changes. You can then download, print, or share the completed Spen Chalan Form as needed.

Start filling out your Spen Chalan Form online today to ensure your appeal is submitted accurately and promptly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.