Loading

Get Wh 1 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Wh 1 2020 online

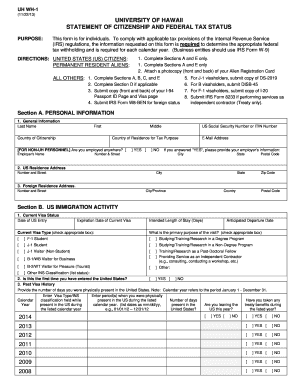

The Wh 1 2020 form, officially known as the Statement of Citizenship and Federal Tax Status, is essential for determining appropriate federal tax withholding for individuals. This guide provides detailed, step-by-step instructions to help you fill out this form accurately, ensuring compliance with tax regulations.

Follow the steps to complete the Wh 1 2020 form online.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin filling out Section A: Personal Information. Enter your last name, first name, middle name, country of citizenship, and Social Security Number or ITIN. Input your country of residence for tax purposes and email address. If employed elsewhere, provide the employer's details including name, address, city, state, and zip code.

- Complete the US Residence Address section with your current address, including the number and street, city, and state.

- Fill out the Foreign Residence Address if applicable. Include the number and street, city or province, country, and postal code.

- Move to Section B: US Immigration Activity. Provide your current visa status, date of US entry, expiration date of the current visa, and the visa type. Indicate the intended length of stay and anticipated departure date.

- Answer the question regarding whether this is your first time entering the United States, and provide details about your past visa history, including the number of days you were physically present in the US for each calendar year.

- Proceed to Section C: Tax Status Determination. Complete the Substantial Presence Test by filling out the required table. If necessary, respond to the questions regarding your days present in the US.

- Based on your responses, determine your tax status and proceed to the appropriate section. If you qualify as a resident alien, continue to Section E. If not, proceed to Section D.

- In Section D, consider whether to claim an exemption from withholding. Check the relevant box and attach the necessary IRS forms based on your status.

- Finally, complete Section E by certifying that your provided information is accurate. Include the date and your signature.

- After completing the form, save your changes, download the file, or print it for your records before submitting it according to your local requirements.

Start filling out your Wh 1 2020 form online today for accurate compliance with federal tax regulations.

WH-1 STATEMENT OF CITIZENSHIP AND FEDERAL TAX STATUS PURPOSE: In order to comply with applicable tax provisions of the Internal Revenue Service (IRS), the information requested on this. form is required. The University will use this information to determine the appropriate federal tax withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.