Loading

Get Transaction Statement (form 12.6) Office Of State Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transaction Statement (Form 12.6) Office Of State Revenue online

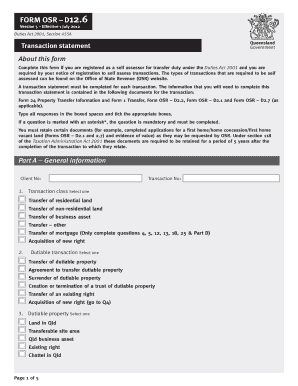

This guide provides a step-by-step approach to filling out the Transaction Statement (Form 12.6) for the Office Of State Revenue online. By following these instructions, users can effectively complete the form required for self-assessing transactions related to transfer duty under the Duties Act 2001.

Follow the steps to accurately complete the Transaction Statement online.

- Click the ‘Get Form’ button to obtain the Transaction Statement (Form 12.6) and open it in your document management tool.

- In Part A, enter the General Information. Fill out the Client Number and Transaction Number. Choose the applicable transaction class by selecting from the provided options such as 'Transfer of residential land' or 'Transfer of mortgage.'

- Complete the Dutiable Transaction section by selecting the appropriate type of transaction among choices like 'Transfer of dutiable property' or 'Surrender of dutiable property.' Then specify the Dutiable Property type.

- For the Transaction/Document Date, indicate the date pertinent to the transaction.

- Answer whether there is a written agreement by selecting 'Yes' or 'No' and proceed to provide additional details if required.

- Fill out Part B by providing Property and Party Details. Include a description of the property and complete the transferor and transferee details accordingly. Use Annexure C for more than two parties.

- In Part C, Transaction Information, confirm if the transferor and transferee are related, and indicate the consideration or value of the property, ensuring that you follow instructions based on previous questions.

- Complete Part D by providing the Payment Information. Include amounts related to duty payable and any deductions applicable.

- Finally, in Part E, complete the Acknowledgement section. Ensure that you include the signature of an authorised person, their name, date, and contact phone.

- After completing the form, you can save your changes, download, print or share the Transaction Statement as necessary.

Complete your transaction statement online today to ensure compliance with the Duties Act 2001.

JobKeeper payments are exempt from Queensland payroll tax. When calculating your threshold amount and the payroll tax rate, you do not include JobKeeper payments. If you pay an employee more than the JobKeeper amount, the extra amount is liable for payroll tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.