Loading

Get Bir Form 1700 Guidelines And Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 1700 Guidelines And Instructions online

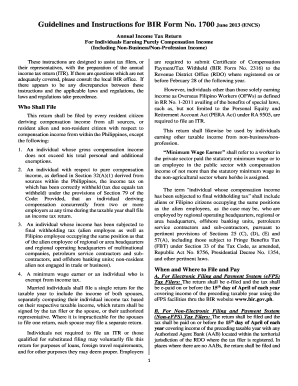

Filling out the Bir Form 1700 is essential for individuals earning purely compensation income, guiding them through their annual income tax return. This guide provides a step-by-step process to help users complete the form online with ease.

Follow the steps to complete your Bir Form 1700.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your taxpayer identification number (TIN) in Item 5. If applicable, include your spouse’s TIN in Item 17.

- Enter the appropriate RDO code in Item 6 as per the BIR Form.

- Input your civil status in Item 13 and claim additional exemptions in Items 14-15 if applicable.

- Document all sources of gross compensation income in the relevant sections, ensuring to indicate any non-taxable income.

- Complete the total tax computation by summarizing your deductions including health insurance premium, personal exemptions, and additional exemptions.

- Upon finalizing all entries, review the net taxable income and calculate your total tax due, referencing the tax tables provided.

- Finalize your form by signing in the designated area and indicating your government-issued ID.

- Once completed, save the changes, and choose to download, print, or share the form as needed.

Complete your Bir Form 1700 online today to ensure timely submission and compliance.

Related links form

Itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Types of itemized deductions include mortgage interest, state or local income taxes, property taxes, medical or dental expenses in excess of AGI limits, or charitable donations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.