Loading

Get Uct 101 E

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Uct 101 E online

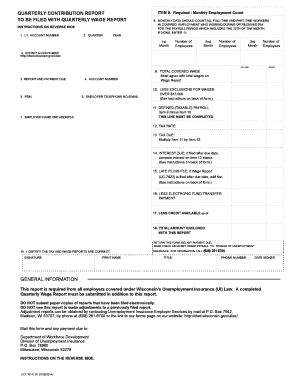

Filling out the Uct 101 E online can streamline your reporting process for unemployment contributions. This guide will walk you through each section of the form, ensuring that you provide accurate information and meet your filing requirements.

Follow the steps to successfully complete your Uct 101 E form.

- Click the ‘Get Form’ button to access the Uct 101 E form and open it in the online editor.

- Begin by reviewing the preprinted items, such as your U.I. account number, quarter, year, and employer details including name and address. Ensure all information is accurate and complete.

- Enter your monthly employment counts for each of the three months covered in the report. Include all full-time and part-time workers in covered employment, entering a zero (-0-) if applicable.

- Input the total covered wages paid during the quarter in Item 9, making sure it aligns with your Quarterly Wage Report. This figure should include various forms of compensation such as salaries, bonuses, and commissions.

- Calculate any exclusions for wages over $13,000 in Item 10 by following the detailed steps provided in the form's instructions to ensure accurate reporting.

- Determine your defined (taxable) payroll in Item 11 by subtracting the exclusion amount from the total covered wages.

- Enter your applicable tax rate, which will be shown as a decimal fraction, in Item 12, and calculate the tax due by multiplying the taxable payroll by the tax rate in Item 13.

- If applicable, calculate any interest due (Item 14) based on late filings and include any late filing fees (Item 15) if you filed your Wage Report after the due date.

- If electronic payments have been made, enter these amounts in Items 16 and 17 for deductions from the total amount due.

- Total up the amounts in Item 18, including any deductions to find your final amount enclosed with the report.

- Finally, certify the accuracy of your report by signing, printing your name, entering your title, phone number, and the date signed before finalizing your submission.

Complete your Uct 101 E form online today to ensure timely and accurate reporting.

This makes our site faster and easier to use across all devices....Unemployment Insurance 2023 Tax Rates. New Employer RatesPayroll less than $500,0003.05%3.05%3.05%Payroll greater than $500,000Construction Industry10 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.