Loading

Get Final Return Form - Maryland Tax Forms And Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Final Return Form - Maryland Tax Forms And Instructions online

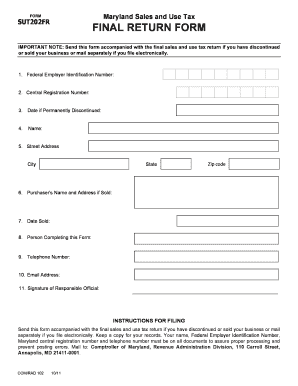

Filling out the Final Return Form is an essential step for users who have discontinued or sold their business. This guide provides step-by-step instructions to help users accurately complete the form online.

Follow the steps to complete the Final Return Form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Federal Employer Identification Number in the designated field. This number is crucial for identifying your business entity.

- Provide your Central Registration Number. This is important for the Maryland business identification process.

- Indicate the date your business was permanently discontinued. This helps in setting the official closure date of your business.

- Complete the field for your business name. This ensures that all records reflect the correct name of the business that is closing.

- Fill out your street address, city, state, and zip code to provide your business location details.

- If the business was sold, enter the purchaser's name and address. This information is necessary for transferring obligations and responsibilities.

- Record the date of the sale of the business if applicable. This date is essential for proper tax processing.

- Provide the name of the person completing this form. This indicates the responsible individual for the information provided.

- Include a telephone number where you can be reached for any follow-up questions regarding the form.

- Add your email address for electronic communication. This facilitates quicker correspondence.

- Ensure the signature of the responsible official is provided. This acts as an affirmation of the information given.

- Once completed, you can save changes to the form, download it for your records, print a copy, or share the finalized form as needed.

Complete your documents online to ensure a smooth filing process.

Place Form PV with attached check/money order on TOP of Form 502 and mail to: Comptroller of Maryland Payment Processing PO Box 8888 Annapolis, MD 21401-8888 DIRECT DEPOSIT OF REFUND (See Instruction 22.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.