Loading

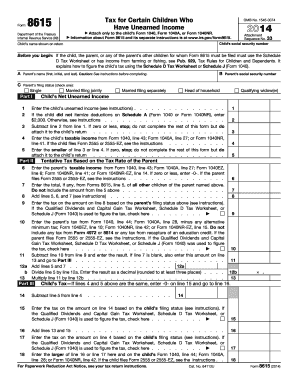

Get 2014 Form 8615. Tax For Certain Children Who Have Unearned Income - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 Form 8615. Tax for certain children who have unearned income - IRS online

Filling out the 2014 Form 8615 can seem challenging, but with a clear guide, users can navigate through it confidently. This form is essential for reporting taxes for certain children who receive unearned income, ensuring compliance with IRS regulations.

Follow the steps to successfully complete the form.

- Click 'Get Form' button to access the form and open it in your preferred PDF viewer or editor.

- Provide the child's social security number and name as shown on the return. Ensure this information matches the details on the Form 1040, Form 1040A, or Form 1040NR being filed.

- Enter the parent's name (first, initial, and last) in the designated area. Carefully review the instructions if unsure about this section.

- Select the parent's filing status by checking the appropriate box. Options include single, married filing separately, married filing jointly, head of household, or qualifying widow(er).

- Fill in the child's net unearned income. If the child did not itemize deductions on Schedule A, enter $2,000. If they did, follow the specific instructions to calculate this value accurately.

- Subtract the value from line 2 from line 1. If the result is zero or less, stop filling out this form and attach it to the child's return instead.

- Record the child's taxable income from the appropriate line of the Form 1040, Form 1040A, or Form 1040NR. If they file Form 2555 or 2555-EZ, consult the instructions.

- Enter the smaller value between line 3 and line 4. If this number is zero, stop and attach the form to the child's return.

- Proceed to Part II, where you will enter the parent's taxable income as instructed. Ensure it aligns with the lines noted for forms 1040 or 1040A.

- After that, complete the calculations required in Part II to determine the tentative tax based on the parent's tax rate.

- Move on to Part III to calculate the child's tax, following the specific instructions if lines 4 and 5 have identical values.

- Once complete, review the entries carefully, ensuring all information is accurate before finalizing.

- Save changes, download, print, or share the completed form as necessary. Ensure you retain a copy for personal records.

Complete your 2014 Form 8615 online to ensure your tax obligations are fully met.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A child whose tax is figured on Form 8615 may be subject to the Net Investment Income Tax (NIIT). NIIT is a 3.8% tax on the lesser of net investment income or the excess of the child's modified adjusted gross income (MAGI) over the threshold amount. Use Form 8960, Net Investment Income Tax, to figure this tax.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.