Loading

Get Nd Probate Code Form 14 - Ndcourts.gov - Ndcourts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the ND PROBATE CODE FORM 14 - Ndcourts.gov - Ndcourts online

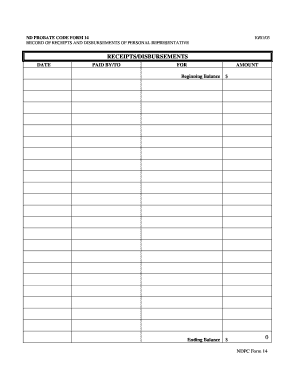

Filling out the ND Probate Code Form 14 is a crucial step in documenting the financial activities of a personal representative. This guide will walk you through each section of the form to ensure accurate and complete submission.

Follow the steps to complete the ND Probate Code Form 14:

- To start, click the ‘Get Form’ button to obtain the form and open it in the editing tool.

- Begin by entering the date of each transaction in the receipts/disbursements section. This helps to maintain a chronological order of all financial activities.

- In the 'Paid by/To' field, specify who made the payment or who received the funds. Be clear and precise with the names to avoid any confusion.

- For the 'For' field, provide a brief description of what the payment was for. This could relate to expenses incurred or income received during the administration of the estate.

- In the 'Amount' field, input the monetary value of each transaction. Ensure that these amounts are accurate as they will affect the financial summary.

- At the end of your entries, calculate the 'Beginning Balance' and 'Ending Balance' to reflect the financial status accurately. Be sure to double-check your calculations.

- Once you have filled out all necessary fields, you can save your changes. From here, options to download, print, or share the completed form will be available to you.

Complete your documents online for a more efficient and streamlined process.

North Dakota probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.