Loading

Get Gao-502 Employee Expense Reimbursement Form - General ... - Gao Az

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GAO-502 Employee Expense Reimbursement Form - General ... - Gao Az online

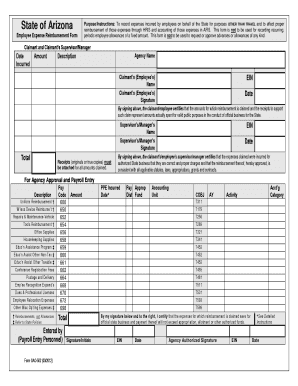

This guide provides step-by-step instructions for completing the GAO-502 Employee Expense Reimbursement Form online. The form is used by employees to report expenses incurred on behalf of the State of Arizona, ensuring proper reimbursement and accounting.

Follow the steps to fill out the form accurately and efficiently.

- Click the ‘Get Form’ button to access the GAO-502 Employee Expense Reimbursement Form and open it in your editing tool.

- In the Claimant and Claimant’s Supervisor/Manager section, fill in the Employee's name, EIN, and Signature. Ensure to date this section properly.

- Specify the Agency Name and enter the Date and Amount Incurred for each expense in the corresponding fields.

- For each expense, provide a Description that details the nature of the expenditure. Ensure the Date Incurred corresponds with when the expense was made.

- Calculate the total amount claimed. This value must match the sum of the amounts listed in the Amount column of your individual expense entries.

- In the lower section, labeled For Agency Approval and Payroll Entry, replicate the total from the Claimant section.

- Complete additional fields as required: Pay Code, PPE Incurred Date, Pay Dist, Approp Fund, Accounting Unit, AY, Activity, and Acct’g Category. Ensure accuracy in these sections.

- Attach the original receipts or true copies that support all claimed amounts to the form.

- Once all information is filled out and verified for accuracy, save your changes. You can then download, print, or share the form as required.

Complete the GAO-502 Employee Expense Reimbursement Form online to ensure timely reimbursement for your expenses.

Mileage for use of personal vehicles on project related activities is reimbursed at the State of Arizona rate of $0.445 per mile. d. Company owned vehicle mileage may be reimbursed at a rate developed by the Consultant based on actual costs incurred.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.