Loading

Get Unforseen Emergency Withdrawal Application - Calpers ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Unforeseen Emergency Withdrawal Application - CalPERS online

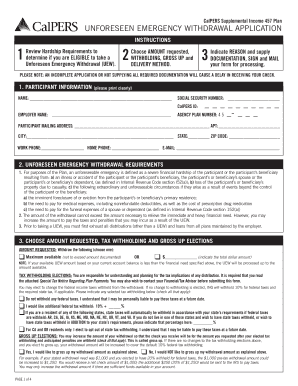

The Unforeseen Emergency Withdrawal Application from CalPERS allows individuals to request a withdrawal in times of financial hardship. This comprehensive guide will walk you through the steps to complete the form online in a clear and user-friendly manner.

Follow the steps to accurately complete your application online.

- Click ‘Get Form’ button to access the Unforeseen Emergency Withdrawal Application and open it in your chosen form editor.

- Review the hardship requirements outlined at the start of the application to determine if you meet the eligibility for a withdrawal.

- Fill in the participant information section carefully. Provide your name, social security number, agency plan number, and contact details including mailing address, phone numbers, and email.

- In the 'Unforeseen Emergency Withdrawal Requirements' section, read about the types of emergencies eligible for withdrawal and prepare to indicate your reason.

- Select the amount you are requesting to withdraw. Choose between the maximum amount or specify a dollar amount that meets your financial need.

- In the tax withholding elections section, decide how much federal and state tax you want withheld from your withdrawal. Review the implications carefully or consult a financial advisor.

- Choose how you prefer to receive the funds - either through standard first-class mail or expedited delivery for an additional fee.

- Provide a valid reason for the withdrawal and ensure you gather the required documentation to substantiate your claim.

- Sign the form in the authorization section and have your employer review and sign it as well.

- If applicable, include spousal consent if you are married. If the spouse cannot sign, complete the justification section.

- Before finalizing, double-check that you have completed all sections and included all necessary documentation. Save changes, download a copy, and either print or share the form as needed.

Complete your Unforeseen Emergency Withdrawal Application online today to ensure timely processing.

If you receive your refund before age 59 ½ years, you may have to pay an additional 10% federal income tax and an additional 2.5% state income tax for early distribution.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.