Loading

Get Erisa Fidelity Bond Order Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ERISA Fidelity Bond Order Form online

Filling out the ERISA Fidelity Bond Order Form online can streamline the process of securing a bond for your retirement plans. This guide provides clear instructions to help you navigate through each section of the form efficiently.

Follow the steps to complete the ERISA Fidelity Bond Order Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

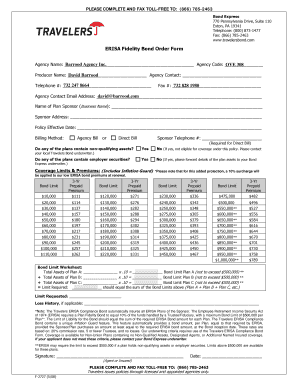

- Enter the agency name and agency code in the designated fields at the top of the form.

- Input the producer name and the agency contact information, including telephone number and fax number.

- Fill in the agency contact email address to ensure communication can occur seamlessly.

- Provide the name of the plan sponsor and their complete address in the specified areas.

- Select the policy effective date by clearly indicating the desired date.

- Choose the billing method by selecting either 'Agency Bill' or 'Direct Bill' using the corresponding checkbox.

- Enter the sponsor's telephone number to facilitate further communication.

- Indicate whether any of the plans contain non-qualifying assets or employer securities by checking 'Yes' or 'No' as applicable.

- Complete the coverage limits and premiums section by selecting the appropriate bond limit and its corresponding three-year prepaid premium.

- Complete the bond limit worksheet by calculating the total assets for each plan and applying the 10% factor to determine the bond limits.

- Provide loss history if applicable to give context to the bond application.

- Sign and date the form in the designated fields to validate the order.

- After completing all sections, review your entries for accuracy, then save your changes, download, print, or share the completed form as necessary.

Ensure you complete the ERISA Fidelity Bond Order Form online for a smoother submission process.

Average Cost: $116 – $425 for a 3 year term, based on the bond amount. Bond Amount: Minimum of 10% of the total plan assets. Who Needs It: Employee benefit plan trustees. Purpose: To ensure that plan beneficiaries will receive compensation for financial harm should the fiduciary commit fraud or dishonest acts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.