Loading

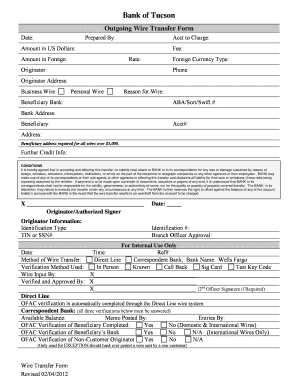

Get Wire Transfer Form To Document Ofac Check On Outgoing Wires

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wire Transfer Form To Document OFAC Check On Outgoing Wires online

Filling out the Wire Transfer Form To Document OFAC Check On Outgoing Wires is essential for ensuring your wire transfers comply with regulatory requirements. This guide provides step-by-step instructions to help users confidently complete the form online, ensuring all necessary information is accurately submitted.

Follow the steps to complete your wire transfer form online.

- Click 'Get Form' button to obtain the form and open it in your preferred editor.

- Enter the date of the transaction in the designated field.

- Fill in your name or the name of the person preparing the form under 'Prepared By'.

- Provide the account number that will be charged for this transfer under 'Acct to Charge'.

- Specify the amount of the transfer in US dollars in the 'Amount in US Dollars' field. If applicable, also provide the amount in foreign currency.

- Indicate any associated fees in the 'Fee' section and the exchange rate, if applicable.

- Select the type of foreign currency from the 'Foreign Currency Type' dropdown.

- Complete the 'Originator' section with your name, phone number, and address. Choose whether it is a business or personal wire.

- State the reason for the wire transfer in the 'Reason for Wire' field.

- Provide the beneficiary bank details, including the bank’s ABA/Sort/Swift number and address.

- Fill in the beneficiary's name and account number. Ensure to include the beneficiary address, especially for wires over $3,000.

- Complete any further credit information as needed.

- Sign the form in the designated space for the originator or authorized signer.

- Specify the identification type and provide documents like TIN or SSN as required.

- Obtain branch officer approval by having the designated officer sign the form.

- Lastly, ensure all internal use sections, such as verification method and OFAC checks, are filled out correctly.

- After completing all sections, save changes, and remember to download, print, or share the form as needed.

Start filling out your wire transfer form online today!

The wire will not incure a Form 8300 to the IRS nor a Currency Transaction Report to the Treasury's FinCEN department (contrary to the accepted answer). Only in person cash to bank account (deposit), and bank account to cash (withdrawal) is reported via currency transaction reports.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.