Loading

Get Chapter 6 Practice Test Journals Source Documents Taxes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chapter 6 Practice Test Journals Source Documents Taxes online

This guide provides step-by-step instructions for completing the Chapter 6 Practice Test Journals Source Documents Taxes form online. Whether you are a student or a professional looking to refresh your knowledge, this comprehensive guide will help you navigate through the form with ease.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to access the Chapter 6 Practice Test Journals Source Documents Taxes form and open it for editing.

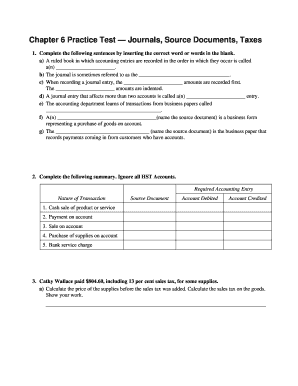

- Begin by completing the first section which requires filling in the blanks with the appropriate terms related to journal entries in accounting.

- Proceed to the summary section where you will identify the required accounting entry for different types of transactions, including the source document, account debited, and account credited.

- In the next section, perform calculations based on the provided example regarding sales tax on supplies. Show your work clearly for each step.

- Answer the questions related to the source document provided, ensuring to identify the type of document, its purpose, who issued it, and the corresponding journal entries that would be made by both the sender and receiver.

- Complete the HST data schedule by filling in the amounts for HST recoverable and HST payable for the specified periods.

- Lastly, journalize the various transactions listed, including sales, expenses, and payments. Ensure all calculations for taxes are accurately reflected as required.

- Once all sections are filled out, review your entries for any errors, and then you may save your changes, download the completed form, print it, or share it as needed.

Start filling out your Chapter 6 Practice Test Journals Source Documents Taxes online today!

Some examples of source documents include: Bank Statements. Payroll Reports. Invoices. Leases & Contracts. Check Registers. Purchase Orders. Deposit Slips – not included on a bank statement. Check Copies – not included on a bank statement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.