Loading

Get Combined Tax Return Form Sc 2013 - Portland

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

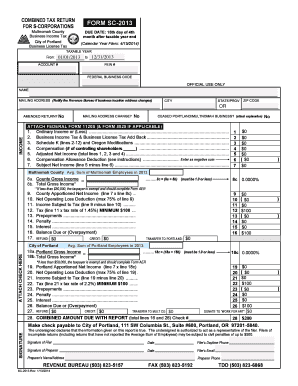

How to use or fill out the COMBINED TAX RETURN FORM SC 2013 - Portland online

Filling out the Combined Tax Return Form SC 2013 for Portland can seem overwhelming. However, this guide is designed to help you navigate each section of the form with clarity and ease, ensuring you provide all necessary information accurately.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Enter your taxable year, usually reflected as the period for financial reporting, from January 1 to December 31. This helps ensure that all financial data is relevant to the same year.

- Complete the account number and Federal Employer Identification Number (FEIN) fields, ensuring correct information for identification purposes.

- Provide your entity's legal name and mailing address. Make sure to keep this information updated with the Revenue Bureau in case of any changes.

- Indicate whether this is an amended return or if there are any changes in the mailing address. If your business has ceased operation, attach an explanation.

- Input your ordinary income or loss as per your financial records. This data will serve as the base for calculating your business taxes.

- Add back the business income tax and business license tax to your total income. This is crucial for an accurate tax calculation.

- Include amounts from Schedule K and any pertinent Oregon modifications that affect your business income or losses.

- Document the compensation for controlling shareholders, including any salaries or wages, as this will factor into your net income calculations.

- Calculate your adjusted net income by summing the previous entries and inputting the result in the corresponding field.

- Deduct the compensation allowance based on the calculated figures, as per the form’s instructions.

- Determine your subject net income by subtracting the compensation allowance from your adjusted net income.

- Complete the sections for gross income, prepayments, and penalties as applicable to your business activities over the tax year.

- Finalize your balance due or overpayment calculations by following the instructions to ensure accuracy.

- Review all sections for completeness and correctness. Once verified, save your changes and prepare to submit the form through the appropriate channels.

Start filling out your Combined Tax Return Form SC 2013 online today for a smooth filing experience.

Multnomah County Justice and Equity Agenda.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.