Loading

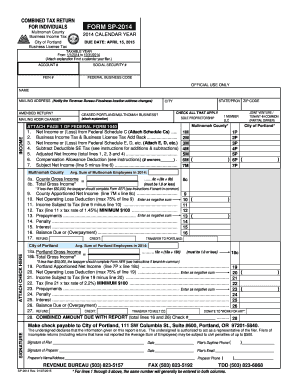

Get Combined Tax Return For Individuals Form Sp-2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the COMBINED TAX RETURN FOR INDIVIDUALS FORM SP-2014 online

Filling out the Combined Tax Return for Individuals Form SP-2014 online can streamline your tax reporting process. This guide offers clear, step-by-step instructions on completing the necessary fields to ensure accurate submission.

Follow the steps to successfully complete your tax return online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the taxable year at the top of the form. If you are not filing for a calendar year, attach an explanation.

- Fill in your account number, social security number (SSN), federal employer identification number (FEIN), and the federal business code.

- Provide your name and mailing address. If your business location has changed, update it here.

- Indicate if this is an amended return by marking the appropriate box.

- Enter your net income or loss from federal Schedule C and attach the Schedule C forms.

- Add back business income tax and business license tax to your net income.

- Include additional income or loss from federal Schedule E or D as necessary.

- Subtract any deductible self-employment tax from your total to find your adjusted net income.

- Calculate your compensation allowance deduction and subtract this from your adjusted net income.

- Proceed to calculate your county and city apportioned net income based on the criteria given in the form.

- Complete the tax calculations for both Multnomah County and the City of Portland, ensuring to consider deductions and penalties where applicable.

- At the bottom of the form, provide your signature, date it, and include your daytime phone number and email.

- Once you have filled out all necessary fields, save changes, and prepare to download or print the completed form for your records.

Complete your tax return online today for a smooth filing experience.

It may benefit you to file an old return before a demand is made. There is no time limit for submitting a previously unfiled return, but if you still want to claim a refund, you have up to 3 years from the return's due date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.