Loading

Get Verso Claim Status Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Verso Claim Status Form online

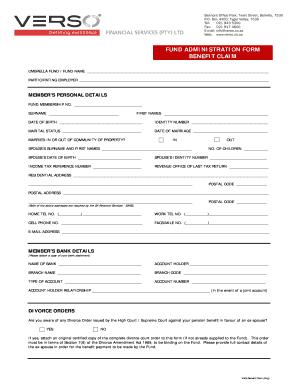

Filling out the Verso Claim Status Form online is a straightforward process that allows users to efficiently provide necessary personal and financial information for their claims. This guide will walk you through each section, ensuring you have all the information needed for successful submission.

Follow the steps to fill out the Verso Claim Status Form online effectively.

- Press ‘Get Form’ button to access the Verso Claim Status Form and open it in your online editor.

- Enter the umbrella fund or fund name in the designated field.

- Provide the participating employer's name in the specified area.

- Fill in your fund membership number and personal details, including your surname, first names, date of birth, identity number, and marital status.

- Indicate your date of marriage and specify whether married in or out of community of property.

- Input your spouse’s surname and first names, if applicable, and their date of birth and identity number.

- Include your income tax reference number and the revenue office of your last tax return.

- Complete your residential address and postal address, along with the relevant postal codes.

- Provide your home telephone number, work telephone number, cell phone number, facsimile number, and email address.

- Fill in your bank details, including the bank name, account holder name, branch name, branch code, type of account, and account number.

- If applicable, indicate your awareness of any divorce orders pertaining to your pension benefits and attach certified copies.

- Complete the benefit options section for withdrawal and retirement claims, specifying amounts or percentages as necessary.

- Fill in the detailed employer section, including termination of service date and reason for termination.

- If there is a prior claim, specify details and provide necessary proofs.

- Complete the employer banking details section and sign off with the required date.

- Review all entered information for accuracy, and ensure to attach any necessary documents before submission.

- Save changes, download, print, or share the completed form as required.

Begin completing your documents online today for a smoother claims process.

Know: You will pay taxes on your lump-sum payout. Your lump sum money is generally treated as ordinary income for the year you receive it (rollovers don't count; see below). For this reason, your employer is required to withhold 20 percent of the payout.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.