Loading

Get Form 169

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 169 online

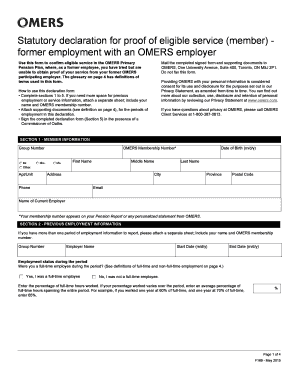

Filling out the Form 169 online is a straightforward process that allows you to confirm your eligible service in the OMERS Primary Pension Plan. This guide provides detailed, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Form 169 online:

- Click the ‘Get Form’ button to access the Form 169 and open it in your preferred editing tool.

- In Section 1, enter your member information, including your OMERS membership number, first and last name, date of birth, address, phone number, email, and current employer's name.

- Proceed to Section 2, where you will provide your previous employment information. Include the employer's name, start and end dates, and indicate whether you were a full-time employee. If needed, attach a separate sheet for additional employment periods.

- In Section 3, answer the questions regarding any breaks in service or absences during your previous employment. If you answer 'Yes,' provide the relevant dates and types of absences.

- Section 4 requires information on any previous pension plan memberships. Answer whether you were a member of a registered pension plan and provide the necessary details if applicable.

- Complete Section 5 by reading the declaration carefully. You must sign the form in the presence of a Commissioner of Oaths, who will also fill out the required details in this section.

- Once you have filled out all relevant sections, review your completed form for accuracy. Save your changes, and you can then download, print, or share the completed Form 169 as needed.

Start completing your Form 169 online today!

Entities using the EZ computation method forego any credits for that report year, including the temporary credit for business loss carryforwards. The franchise tax rate for entities choosing to file using the EZ computation method is 0.331% (0.00331).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.