Loading

Get Flexible Spending Account Fsa Data Collection Worksheet - Benefits

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Flexible Spending Account FSA Data Collection Worksheet - Benefits online

Filling out the Flexible Spending Account (FSA) Data Collection Worksheet is an essential step in managing your benefits effectively. This guide will navigate you through the online form, ensuring you understand each section and can complete it accurately.

Follow the steps to fill out the FSA Data Collection Worksheet online.

- Press the ‘Get Form’ button to access the FSA Data Collection Worksheet and open it in your preferred document editor.

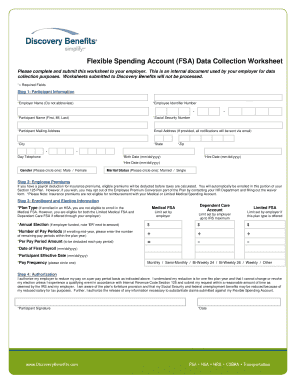

- In the Participant Information section, fill in your Employer Name without abbreviations, your Employee Identifier Number, and your full name (First, MI, Last). Make sure to include your Social Security Number, mailing address, email address (for notifications, if applicable), city, state, zip code, day telephone number, birth date in mm/dd/yyyy format, and hire date also in mm/dd/yyyy format. Select your gender and marital status by circling either Male/Female and Married/Single respectively.

- Move to the Employee Premiums section. If applicable, understand that your payroll deductions for insurance premiums will be taken before taxes are calculated unless you contact your HR Department to opt-out.

- In the Enrollment and Election Information section, indicate your Plan Type. Fill in the Annual Election amounts, noting employer funding where applicable. Specify the Per Pay Period Amount to be deducted, the Number of Pay Periods, the Date of First Payroll, and the Participant Effective Date. Choose your Pay Frequency by circling one option provided.

- Conclude by reviewing the Authorization section carefully. Confirm your understanding of the plan's conditions and sign and date where indicated to authorize the reduction of your pay.

- Once all sections are completed, save your changes, download the form, print a copy for your records, or share it as required with your employer.

Complete your FSA Data Collection Worksheet online today to ensure your benefits are managed effectively.

Here's how an FSA works. Money is set aside from your paycheck before taxes are taken out. You can then use your pre-tax FSA dollars to pay for eligible health care expenses throughout the plan year. You save money on expenses you're already paying for, like doctors' office visits, prescription drugs, and much more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.