Loading

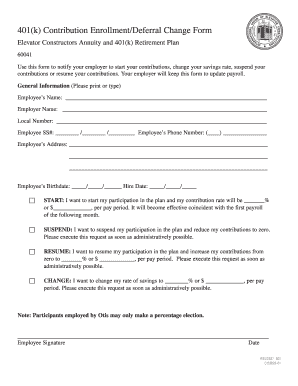

Get 401(k) Contribution Enrollment/deferral Change Form - Iuec85

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 401(k) Contribution Enrollment/Deferral Change Form - Iuec85 online

Filling out the 401(k) Contribution Enrollment/Deferral Change Form - Iuec85 online is essential for managing your retirement contributions effectively. This guide provides detailed, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the General Information section. This includes your name, employer name, local number, social security number, phone number, address, birthdate, and hire date. Make sure to print or type clearly.

- Indicate your desired action by selecting one of the options: start, suspend, resume, or change your contributions. For starting, specify the contribution rate as a percentage or dollar amount per pay period. Make sure to understand that this will become effective with the first payroll of the following month.

- If you wish to suspend your participation, clearly state that you want to reduce your contributions to zero. Your employer will process this request as promptly as possible.

- To resume contributions, indicate the new contribution rate or amount per pay period you wish to begin after suspension, making sure this request is executed swiftly.

- For changing your savings rate, fill in the new percentage or dollar amount you want to contribute per pay period, ensuring the employer will execute this as soon as they can.

- After completing the form, review all entries for accuracy. Once satisfied, sign and date the form in the designated areas.

- Finally, save changes, download or print the completed form, or share it as required for submission to your employer.

Start filling out your 401(k) Contribution Enrollment/Deferral Change Form online today!

Salary deferrals are funds taken from your regular paycheck and put into a retirement savings plan, such as a 401(k). They are most often made from pre-tax income, which allows savers to reduce the amount of their income that's considered taxable by the Internal Revenue Service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.