Loading

Get Form Cift-401w Schedule - Louisiana Department Of Revenue - Revenue La

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CIFT-401W Schedule - Louisiana Department Of Revenue - Revenue La online

This guide provides clear, step-by-step instructions on filling out the Form CIFT-401W Schedule for the Louisiana Department of Revenue. Whether you are a new user or looking to refresh your understanding, this resource is designed to assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete the Form CIFT-401W Schedule

- Click ‘Get Form’ button to obtain the form and open it in the editor.

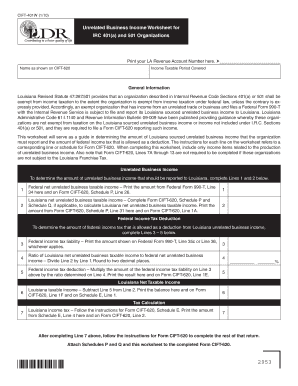

- Print your Louisiana Revenue Account Number in the designated space provided at the top of the form.

- Fill in your name as it appears on the CIFT-620 form.

- Specify the income tax period that is covered by this report.

- For unrelated business income, complete Lines 1 and 2 by referencing your figures from the Federal Form 990-T. Ensure you print the correct amounts as follows: Line 1 for federal net unrelated business taxable income and Line 2 for Louisiana net unrelated business taxable income.

- Complete Lines 3 to 5 to determine the federal income tax deduction. Record the federal income tax liability on Line 3 and calculate the ratio for Line 4 by dividing Line 2 by Line 1.

- For Line 5, multiply the federal income tax liability by the ratio from Line 4 and print the result.

- Subtract Line 5 from Line 2 to determine the Louisiana taxable income for Line 6.

- Follow the Form CIFT-620 instructions for completing Line 7 and record the amount here.

- Attach Schedules P and Q, as well as this worksheet, to your completed Form CIFT-620.

- Finally, review all entries for accuracy and proceed to save changes, download, print, or share the completed form as needed.

Start completing your documents online today for a smooth filing experience.

The Louisiana Department of Revenue is responsible for administering and enforcing tax laws and related statutes established by the state. ... The office also monitors licenses for compliance with gaming laws and regulations and trains gaming organizations in the proper use of the Uniform Accounting System.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.