Loading

Get Louisiana Cift 620 Instructions 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Louisiana Cift 620 Instructions 2019 online

This guide provides users with a detailed walkthrough for completing the Louisiana CIFT 620 form online. Our aim is to assist everyone, regardless of their legal experience, in navigating the complexities of tax reporting.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the CIFT-620 form. Ensure that your browser opens the form in a new tab or window.

- Begin by entering your Louisiana Revenue Account Number at the top of the form. This is mandatory; otherwise, you may face penalties for negligence.

- Indicate your corporation type (domestic or foreign) in the designated fields and fill out the corresponding sections based on your classification.

- Complete all applicable lines and schedules of the return to avoid delays in processing. Use the specific instructions provided alongside each section of the form to guide your completion.

- Provide detailed figures for net income, including any applicable adjustments or exclusions as required by Louisiana tax law.

- If applicable, indicate any estimated tax payments made during the year to ensure proper credit against your total tax liability.

- After completing the form, review all entries for accuracy before submission. Make use of the preview option where available to ensure everything appears correctly.

- Finally, save your changes, then download or print the completed form for your records. You can also share the completed form via email if needed.

Complete your Louisiana CIFT 620 form online today to ensure timely and accurate tax filings.

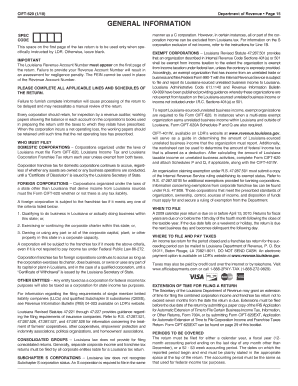

WHO MUST FILE? DOMESTIC CORPORATIONS – Corporations organized under the laws of Louisiana must file an income and franchise tax return (Form CIFT-620) each year unless exempt from both taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.