Loading

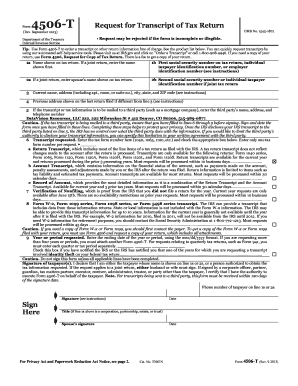

Get Form 4506-t - Wells Fargo

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4506-T - Wells Fargo online

Filling out Form 4506-T is an essential step for users who need to request their tax return information from the Internal Revenue Service. This guide will provide you with clear, user-friendly instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out Form 4506-T effectively.

- Press the ‘Get Form’ button to access the form and open it for completion.

- Enter the name shown on your tax return in line 1a. If filing a joint return, include the name displayed first.

- In line 1b, provide the first social security number, individual taxpayer identification number, or employer identification number associated with your tax return.

- If applicable, enter your spouse’s name in line 2a for joint returns and the second social security number in line 2b.

- Complete line 3 by entering your current name and address, including apartment, room, or suite number, city, state, and ZIP code.

- If your previous address differs from the current one, fill out line 4 with the last address used on your tax return.

- If you wish to send the transcript to a third party, provide their name, address, and phone number in line 5.

- Select the type of transcript you are requesting by entering the tax form number in line 6 and choosing the appropriate checkbox.

- Enter the year or period for which you are requesting a transcript in line 9, using the mm/dd/yyyy format.

- Sign and date the form as the taxpayer listed in line 1a or 2a. Ensure all previous lines are completed before signing. If the information is to be sent to a third party, remember the form must be submitted within 120 days of your signature.

- After completing the form, save your changes, download a copy, and print or share it as required.

Request your tax transcripts online today for seamless document management.

Form 1099-INT Use this form to report interest income on Form 1040, because the bank will send a copy to the IRS and the IRS will compare their copy with the amount you reported on your Form 1040. Keep Form 1040-INT for your records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.