Loading

Get Lst Refund Application - Muniservices

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LST Refund Application - MuniServices online

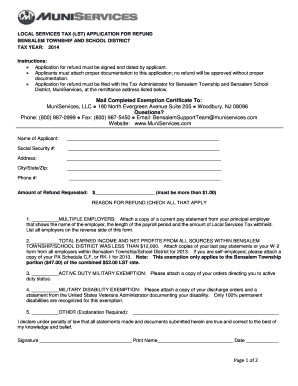

This guide provides step-by-step instructions on how to complete the Local Services Tax (LST) refund application for Bensalem Township and School District online. By following these instructions, users can ensure they successfully submit their application for a refund with minimal difficulty.

Follow the steps to complete your LST refund application online.

- Press the ‘Get Form’ button to access the LST Refund Application form and open it in your online document editor.

- Begin filling out the applicant's name in the designated field as required.

- Provide your social security number in the appropriate section.

- Insert your complete address, including city, state, and zip code, to help in the processing of your application.

- Enter your phone number to enable further communication regarding your application.

- Specify the total amount of refund requested in the designated box, remembering that it must be more than $1.00.

- Select the appropriate reasons for your refund by checking all that apply. Refer to each option, like multiple employers or military exemptions, ensuring to attach necessary documentation as outlined.

- List all places of employment for the applicable tax year. Start by filling out your primary employer details, including address and gross earnings for the year.

- Continue listing any secondary employers in the subsequent fields, ensuring all information is captured correctly.

- Review all entries for accuracy, ensuring that all required fields are completed and that the appropriate documentation is attached.

- Sign and date the application at the bottom, confirming that the information provided is true and correct.

- Finally, save your completed application, then download, print, or share it as necessary before submitting.

Complete your LST refund application online today to start the process.

Related links form

Employers are required to withhold taxes on wages that are earned in the local taxing jurisdiction. If an employee lives in a jurisdiction that also imposes a local tax, the employer can choose to deduct the tax, or make it the responsibility of the employee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.