Loading

Get Authorization Or Cancellation Of A Representative Autorisation Ou

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the AUTHORIZATION OR CANCELLATION OF A REPRESENTATIVE AUTORISATION OU online

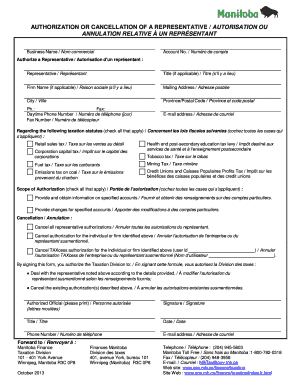

The Authorization or Cancellation of a Representative form is essential for users granting or revoking the authority for another individual or firm to act on their behalf regarding taxation matters. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently, ensuring your needs are met.

Follow the steps to fill out the form properly

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the business name in the designated field. This should reflect the official name of the business for which you are authorizing a representative.

- Input the account number associated with the business. Ensure this number is accurate to avoid processing delays.

- In the 'Authorize a Representative' section, fill in the details of the representative. This includes their name, title if applicable, and firm name if they are representing a business.

- Provide the mailing address of the representative, including city, province, and postal code. Accurate addresses are crucial for communication.

- Enter the representative’s daytime phone number and fax number if available. Also include their email address for electronic communication.

- Indicate which taxation statutes the authorization applies to by checking all relevant boxes. This helps clarify the scope of authority granted.

- In the 'Scope of Authorization' section, check all applicable boxes to specify what the representative is allowed to do regarding your accounts.

- If you are canceling an authorization, check the appropriate boxes to indicate whether you are canceling all or specific authorizations.

- Print your name in the 'Authorized Official' section along with your signature, title, date, phone number, and email address to finalize the form.

- After completing the form, save your changes. You can download, print, or share the form as necessary.

Complete your documentation online today and ensure your representative is accurately authorized.

Form 2848, Power of Attorney and Declaration of RepresentativePDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information AuthorizationPDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.