Loading

Get Payroll Form For Teachers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payroll Form For Teachers online

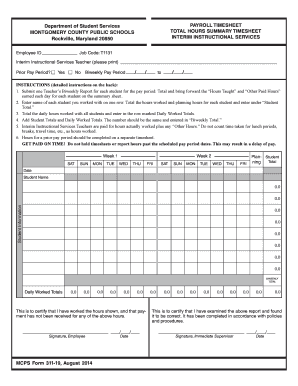

Completing the Payroll Form For Teachers online is essential for timely and accurate payment for your services. This guide provides a clear and supportive overview to help you fill out the form correctly and efficiently.

Follow the steps to accurately complete your payroll submission.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your employee ID and job code, which are required for identification purposes. Ensure that this information is accurate.

- Indicate whether this is a prior pay period by selecting either 'Yes' or 'No'. This will determine how your reported hours are processed.

- Fill in the biweekly pay period dates. Input the start date and end date clearly to ensure the time frame is correctly established.

- List the names of each student you worked with in the designated rows. This is crucial for tracking which hours correspond to which students.

- Total the hours worked each day for every student. Input these totals under the ‘Student Total’ section.

- Sum up the daily hours worked for all students and enter this total in the ‘Daily Worked Totals’ row.

- Confirm that the total of the Student Totals matches the Daily Worked Totals and enter this figure in the ‘Biweekly Total’ field.

- Document any planning hours by following the calculation rule of one hour for every six hours of teaching time and ensure it is rounded correctly.

- Sign and date the form, certifying the accuracy of your reported hours. Your immediate supervisor must also sign and date the form for validation.

- Finally, review the completed form for any errors before saving changes, downloading, printing, or sharing as needed.

Start filling out your Payroll Form For Teachers online today to ensure your timely compensation!

In simple terms, payroll can be defined as the process of paying a company's employees. It includes collecting the list of employees to be paid, tracking the hours worked, calculating the employee's pay, distributing the salary on time, and recording the payroll expense.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.