Loading

Get Check Print Reversal Request - Tax Tech Inc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Check Print Reversal Request - Tax Tech Inc online

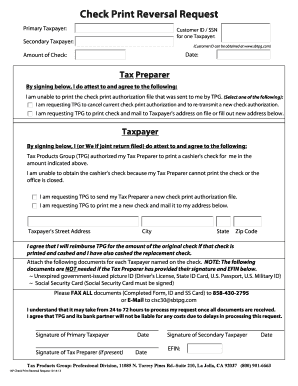

Filling out the Check Print Reversal Request form is an essential process for taxpayers seeking assistance with check printing issues. This guide provides step-by-step instructions to help you complete the form accurately and efficiently in an online format.

Follow the steps to successfully complete the Check Print Reversal Request form.

- Press the ‘Get Form’ button to retrieve the Check Print Reversal Request form and open it in your editor.

- Enter the required information for the primary taxpayer, including your customer ID or Social Security Number (SSN). Make sure to fill in any additional fields requested, such as the date and check amount.

- If applicable, provide details for a secondary taxpayer, including their customer ID or SSN.

- Indicate your request regarding the check print authorization by selecting one of the provided options. This may include asking for a cancellation or requesting a new check to be mailed.

- Provide your street address, city, state, and zip code to ensure proper mailing of any checks.

- Review the agreement section carefully. By signing, you agree to the conditions outlined, especially relating to reimbursement for checks if both the original and replacement checks are cashed.

- Attach the required documents for each taxpayer named on the check, such as an unexpired government-issued ID and a signed Social Security card, unless the Tax Preparer has already provided their signature and EFIN.

- Once the form is completed, fax all documents, including the completed form and attachments, to the designated number or email them to the provided address.

- After submission, note that it may take 24 to 72 hours for processing. Ensure you keep a copy of your submission for your records.

Complete your Check Print Reversal Request form online today to ensure prompt resolution of your check printing issues.

All Payment Options. The Tax Office accepts both full and partial payment of property taxes. Property taxes may be paid online, in person, by mail or by phone. Harris County Property Tax Search Harris County Tax Office https://.hctax.net › Property › PropertyTax Harris County Tax Office https://.hctax.net › Property › PropertyTax

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.