Loading

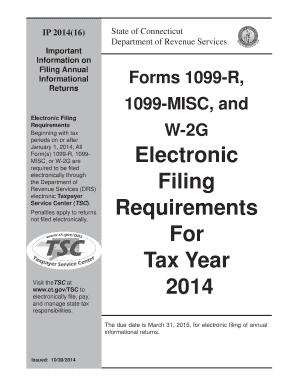

Get 1099 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099 Form online

Filing your 1099 Form online is an important step in reporting income, ensuring compliance with tax regulations. This guide will provide you with clear and supportive instructions for completing the online 1099 Form effectively.

Follow the steps to fill out the 1099 Form online.

- Click ‘Get Form’ button to access the 1099 Form and open it for completion.

- Provide your taxpayer identification number (TIN) in the designated field. Ensure accuracy to avoid issues with tax filings.

- Enter the payer’s information. This includes the payer's name, address, and TIN. Make sure this information is correctly aligned with your records.

- Fill in the payee's details. Include the payee's name, address, and TIN, ensuring that the information is complete and accurate.

- Report the payment amounts in the designated fields according to the nature of the payment. Follow the instructions provided for each amount code.

- Review all the entries for completeness and accuracy. Double-check that all required fields are filled out properly.

- Once satisfied, finalize the form. You have the option to save your changes, download a copy, print it for your records, or share it with relevant parties.

Complete your 1099 Form online today to stay compliant and avoid potential penalties.

To order these instructions and additional forms, go to .irs.gov/form1099s or call 1-800-TAX-FORM (1-800-829-3676).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.