Loading

Get Tax Deductions For Entertainment Professionals Use This Form To Summarize And Organize Your

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Deductions For Entertainment Professionals form online

Filling out the Tax Deductions For Entertainment Professionals form is crucial for summarizing and organizing your tax-deductible business expenses. This guide provides step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to effectively complete your tax deduction form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by reviewing your business expenses and gather all relevant receipts and documentation that can support your deductions.

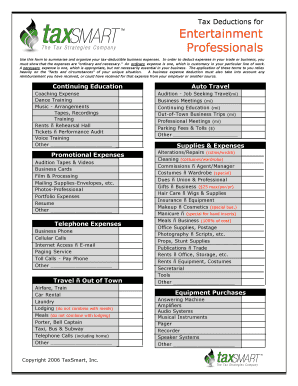

- In the 'Continuing Education' section, list expenses such as coaching, dance training, and other relevant costs. Be sure to separate and categorize all training-related expenses you have incurred.

- In the 'Promotional Expenses' section, input costs associated with audition tapes, business cards, professional photos, and any other materials that assist in promoting your career.

- Fill out the 'Telephone Expenses' section by documenting your business phone, cellular calls, and internet access charges related to your work.

- For the 'Travel – Out of Town' section, detail expenses including airfare, lodging, and other travel-related costs, ensuring not to combine these with your meal expenses.

- Complete the 'Auto Travel' section by recording the mileage for job-seeking travel, business meetings, and other relevant trips. Include any associated parking fees and tolls.

- Continue with the 'Supplies & Expenses' section, documenting costs related to alterations, repairs, office supplies, and any other operational expenses.

- Lastly, fill out the 'Equipment Purchases' section by specifying any equipment, such as musical instruments or audio systems, that have been purchased to support your business.

- Review all entered information for accuracy and completeness. Once you are satisfied with your entries, save your changes, and choose to download, print, or share the form as needed.

Start filling out your Tax Deductions For Entertainment Professionals form online today for accurate tax management.

A business expense is tax deductible. Entertainment is not.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.