Loading

Get 2014 Net Profit Form - Spencer County

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 Net Profit Form - Spencer County online

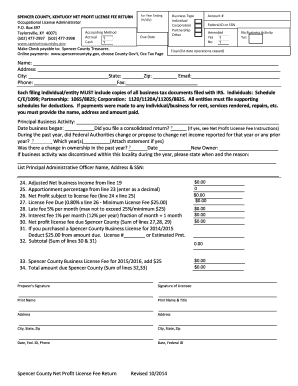

Filing the 2014 Net Profit Form for Spencer County online can help streamline your tax reporting processes. This guide will provide you with clear, step-by-step instructions to ensure that you accurately complete and submit the form.

Follow the steps to fill out the form accurately.

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

- Identify the year for which you are filing the form. Enter the appropriate year in the designated section at the top of the form.

- Indicate your accounting method by selecting either 'Accrual' or 'Cash.' This choice will inform how you report your income and expenses.

- Select the type of business entity you are reporting by checking the corresponding box for Individual, Corporation, Partnership, or Other.

- Provide your account number and Federal ID or Social Security Number in the respective fields.

- If this is an amended return, check 'Yes' or 'No' as appropriate.

- Fill in your business name and address, including the city, state, and zip code.

- Enter your email and phone number for points of contact regarding your filing.

- Disclose whether there was no business activity during the year by selecting 'Yes' or 'No.' If applicable, provide the date operations ceased.

- Complete the section regarding principal business activity and the date your business commenced.

- Answer the questions regarding filing a consolidated return and any changes proposed by federal authorities.

- List any changes in ownership if they occurred within the last year, including the new owner's information.

- Provide detailed information about adjusted net business income, supporting tax documents, and any applicable payments made for rent or services rendered.

- Calculate and enter your adjusted net profit on the specified line as instructed.

- Complete the apportionment calculation to determine the apportionment percentage.

- Compute the license fee due based on the net profit subject to the license fee.

- Include any deductions for prior business licenses and total the amount due on the final line.

- Once all information is accurately filled in and reviewed, you can save your changes, download a copy for your records, print the form, or share it as needed.

Take action now and complete your 2014 Net Profit Form - Spencer County online to ensure compliance and support your business's financial reporting needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.