Loading

Get Eispr4 General Claim Form - State Revenue Office

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EISPR4 General Claim Form - State Revenue Office online

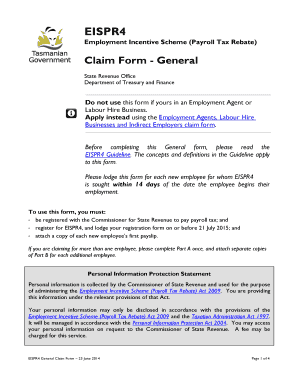

Filling out the EISPR4 General Claim Form online is essential for employers looking to claim the payroll tax rebate under the Employment Incentive Scheme. This guide will provide clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the EISPR4 form with ease.

- Click ‘Get Form’ button to obtain the EISPR4 General Claim Form and open it in your designated editing tool.

- Begin with Part A: Fill in your organisation details, including the employer’s name, trading name, ABN, and your payroll tax registration number. Ensure that all information is accurate to avoid delays.

- Complete your postal address by providing address line 1, address line 2 (if applicable), suburb/town, state, and postcode.

- Provide contact details by including the name of a contact person, work telephone number, fax number (if applicable), and an email address.

- Indicate your Full-Time Equivalent (FTE) Employment level, including the new employee(s) for whom the EISPR4 is being sought. Refer to the EISPR4 Guideline for assistance with this calculation.

- Proceed to Part B: Fill in the details of your new employee. Provide the employee's full name, position title, date of birth, date of employment commencement, and their previous place of employment.

- Indicate whether the employee is full-time or part-time and specify the contracted full-time equivalent hours for part-time employees.

- Answer whether the new employee resulted from a business takeover/merger or employee restructure by selecting 'Yes' or 'No.'

- State the employee's likely annual taxable wages, which are required for your payroll tax return.

- Determine if the employee's position constitutes a net increase to your FTE Base Employment Level by answering 'Yes' or 'No.'

- If applicable, provide details about the previous employee, including their full name, position, and resignation date.

- Attach a copy of the new employee's first payslip as required for processing the claim.

- Sign the declaration stating that the information is accurate and you understand the eligibility criteria. Include your full name and date.

- After completing the form, you can save changes, download, print, or share the form as needed.

Start filling out your EISPR4 General Claim Form online today to take advantage of the payroll tax rebate.

Credit card payments may be made over the telephone by calling 1-800-2PAY-TAX (1-800-272-9829) or over the internet by visiting https://acipayonline.com and clicking the "State Payments" link and either choosing Arkansas or entering the jurisdiction code 1400. Both of these options are available 24 hours a day.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.