Loading

Get Eispr4 Registration Form - State Revenue Office

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EISPR4 Registration Form - State Revenue Office online

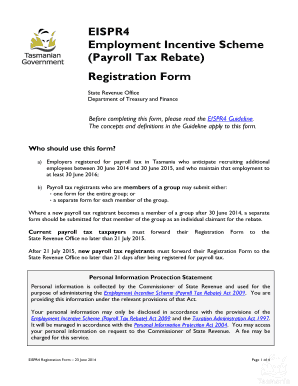

The EISPR4 Registration Form allows employers registered for payroll tax in Tasmania to apply for the Employment Incentive Scheme Payroll Tax Rebate. This guide provides clear, step-by-step instructions for completing the form online to ensure you have all the required information at hand.

Follow the steps to complete the EISPR4 Registration Form with ease.

- Click the 'Get Form' button to access the EISPR4 Registration Form online and open it in your preferred document editor.

- In Section 1, provide your organization's name, trading name, Australian Business Number (ABN), and payroll tax registration number. Ensure all details are accurate for seamless processing.

- Enter your postal address in Section 2, including address line 1 and address line 2, suburb/town, state, and postcode. This is where official correspondence will be sent.

- Fill out your contact details in Section 3. This includes the name of a contact person, work telephone number (including area code), fax number (if applicable), and a valid email address.

- In Section 4, indicate whether you are a member of a group by selecting 'Yes' or 'No'. Depending on your selection, follow the prompts to answer the relevant questions.

- For Section 5, if you answered 'Yes' in Section 4, specify if you are submitting the form for the entire group or as an individual member.

- Section 6 requires you to provide your Full-Time Equivalent (FTE) Base Employment Level as of 29 June 2014. Refer to the guidelines to calculate this accurately.

- In Section 7, specify the frequency with which you pay payroll tax. Options include monthly, quarterly, half-yearly, or annually.

- Section 8 is where you provide the details of the financial institution where your payroll tax rebate should be deposited, including the BSB, account name, and account number.

- Complete the declaration in Section 9 by signing and providing your full name, position, address, and the date. This confirms that you understand the eligibility criteria and that the information provided is accurate.

- Once you have completed the form, save your changes. You have the option to download, print, or share the completed registration form as needed.

Start filling out your EISPR4 Registration Form online today to ensure you meet the necessary deadlines and requirements.

A Nebraska tax power of attorney (Form 33), otherwise known as the Nebraska Department of Revenue Power of Attorney, is a document that can be used to designate a tax professional to represent your interests with the Department of Revenue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.