Loading

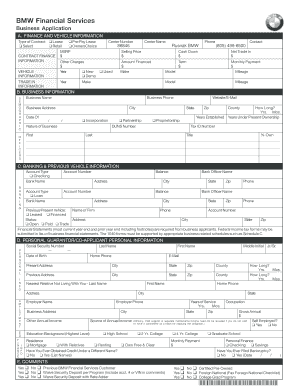

Get Finance And Vehicle Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FINANCE AND VEHICLE INFORMATION online

Filling out the Finance and Vehicle Information form is an essential step in securing financing for your vehicle. This guide will provide clear and concise instructions to help you navigate each section of the form.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by filling out the type of contract. Indicate your choice by selecting 'Lease', 'Pre-Pay Lease', 'Retail', or 'OwnersChoice'.

- Provide your center number and name, ensuring the information matches official records.

- In the finance information section, enter the Manufacturer’s Suggested Retail Price (MSRP), selling price, and cash down amount. Specify any additional charges, the total amount financed, and the desired term.

- Next, fill out the vehicle information. Indicate the year, whether the vehicle is new, used, or demo, and specify the make and model.

- If applicable, detail any trade-in information, including the year, make, model, and mileage of the vehicle you are trading in.

- In the business information section, input your business name, contact details, address, nature of business, and the business’s years of establishment and ownership.

- Provide details about your banking and previous vehicle information, including bank names, account numbers, balances, and the status of previous vehicles (leased or financed).

- Fill in the personal information for the guarantor or co-applicant, including the individual’s name, contact details, social security number, and employment information.

- In the comments section, provide any additional relevant information or requests.

- Review all entries for accuracy before completing the form. You can save changes, download, print, or share the form as needed.

Start filling out your documents online today to ensure timely processing.

Many lenders possess the title during the entire length of the car loan. Once you pay off the loan, the lender removes its name from the title. You then receive a copy of the title. ... If you don't make the payments, however, the lender can take your vehicle.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.