Loading

Get Form 990 Short Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 990 Short Form online

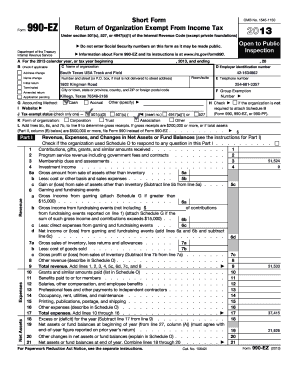

Filing the Form 990 Short Form, also known as Form 990-EZ, is essential for tax-exempt organizations to report financial information to the Internal Revenue Service. This guide provides clear and supportive instructions to help users efficiently fill out the form online.

Follow the steps to fill out the Form 990 Short Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the organization’s employer identification number in the designated field. This is crucial for the IRS to identify your organization accurately.

- Complete the basic information including the organization’s name, address, and telephone number in the specified sections.

- Indicate the type of return you are filing by checking the appropriate box, such as 'initial return' or 'amended return', if applicable.

- Select the organization’s accounting method from the options provided—cash, accrual, or other. This determines how your financial activities will be accounted for.

- Proceed to Part I and report revenue, expenses, and changes in net assets or fund balances. Fill out each line with the required information, ensuring accuracy.

- Continue to Part II to complete the balance sheet, listing details about assets and liabilities. This section clarifies your organization’s financial standing.

- In Part III, provide a concise description of the organization’s primary exempt purpose and program service accomplishments.

- Add the list of officers, directors, and key employees in Part IV, compiling relevant details including compensation.

- Complete Part V by answering any other information necessary and checking any applicable boxes regarding the organization’s activities.

- After all sections are filled out, carefully review the form for completeness and accuracy.

- Finally, save changes, download, print, or share the form as needed.

Start filing your Form 990 Short Form online today to ensure compliance and keep your organization in good standing.

The maximum penalty is $10,000, or 5 percent of the organization's gross receipts, whichever is less. ... An organization that fails to file the required information return (Form 990, Form 990-EZ, or Form 990-PF) or e-Postcard (Form 990-N) for three consecutive tax years will automatically lose its tax-exempt status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.