Loading

Get Ap-152 Application For Payee Identification Number - Texas ... - Window State Tx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AP-152 Application For Payee Identification Number - Texas online

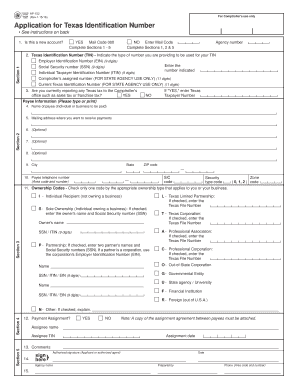

Filling out the AP-152 Application For Payee Identification Number is essential for individuals or businesses seeking to bill state agencies in Texas. This guide provides a clear and supportive approach to completing the form online, ensuring you provide the necessary information accurately.

Follow the steps to complete the AP-152 application online effectively.

- Use the ‘Get Form’ button to access the application form. This action will allow you to open the form in a suitable editor where you can enter the required information.

- Begin with Section 1. Indicate if this is a new account by selecting 'Yes' or 'No'. If it is a new account, complete Sections 1 to 5. If it is not, only Sections 1, 2, and 5 need to be filled.

- Provide your Texas Identification Number (TIN) type that you will be using. Choose from the Employer Identification Number, Social Security Number, Individual Taxpayer Identification Number, or current Texas Identification Number as applicable.

- If you are reporting any Texas tax, select 'Yes' and enter your Texas Taxpayer Number; otherwise, select 'No'.

- Input payee information by entering the name of the payee—either an individual or a business—and then provide the mailing address for payment delivery.

- Complete additional optional information as needed in Section 2, including the city, state, ZIP code, and a contact telephone number.

- In Section 3, select the appropriate ownership code that applies. Make sure to check only one box, and provide any extra information requested.

- For payment assignment, use Section 4. Indicate whether there is a payment assignment by selecting 'Yes' or 'No', and attach a copy of the assignment agreement if applicable.

- In Section 5, you may enter any additional comments or information that could aid in processing your application. Be sure to sign and date the form.

- Review all entered information for accuracy, then save changes, download, or print the completed AP-152 form for submission.

Start the process now by completing your AP-152 application online.

A Payee Information Form (PIF) is a request for a vendor's taxpayer number and applicable tax classification (ownership type). ... The TIN is either the social security number (SSN), Federal Employer Identification Number (FEIN) of the payee, or Individual Tax Payer Identification Number (ITIN).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.