Loading

Get Aboutchet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Aboutchet online

This guide provides clear and supportive instructions on how to complete the Aboutchet form for withdrawing funds from the Connecticut Higher Education Trust. Whether you are new to this process or need a refresher, this step-by-step guide will assist you in ensuring that your withdrawal request is accurate and complete.

Follow the steps to effectively complete the Aboutchet form

- Press the ‘Get Form’ button to obtain the Aboutchet form and open it for editing.

- Read through the Program Disclosure Booklet to understand any tax implications associated with your withdrawal. This is essential for informed decision-making.

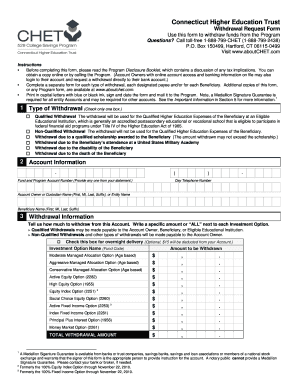

- Select the type of withdrawal by checking only one box. Your options include qualified withdrawals, non-qualified withdrawals, and several specific circumstances such as scholarships or disability.

- Enter your account information, including your Fund and Program Account Number, day telephone number, Account Owner or Custodian's name, and the Beneficiary's name.

- Detail your withdrawal information by writing the specific amount to withdraw next to each Investment Option. Indicate if you would like the funds sent to your bank account or by check.

- Choose the payment option for how you want the funds distributed. Options include payments to the Account Owner, Beneficiary, or directly to the Eligible Educational Institution. Provide required details as needed.

- In the 'Signature and Certification' section, sign and date the form to certify that the information you provided is true and complete. This step is crucial for processing your withdrawal.

- If necessary, attach a Medallion Signature Guarantee for accounts requiring verification and ensure that you mail the completed form to the specified address.

- Once you have reviewed the form for accuracy, you can save the changes, download, print, or share the form as needed.

Complete your Aboutchet form online today to manage your education funds efficiently.

Pros and Cons of 529 Plans AdvantagesDisadvantagesFederal income tax benefits, and sometimes state tax benefitsMust use funds for educationLow maintenanceLimitations on state tax benefitsHigh contribution limitsNo self-directed investmentsFlexibilityFees1 more row

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.