Loading

Get Self Assessment Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Self Assessment Form online

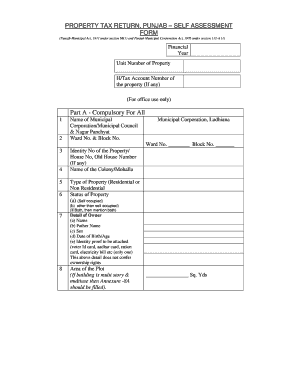

Filling out the Self Assessment Form online is an essential step in accurately reporting your property tax obligations. This guide will walk you through each section of the form, ensuring that you understand how to correctly fill it out.

Follow the steps to complete the Self Assessment Form online.

- Click 'Get Form' button to access the Self Assessment Form and open it in your chosen editor.

- Fill in the financial year and unit number of the property, and provide your H/Tax account number if available. This information helps identify your property details accurately.

- In Part A, input the name of your Municipal Corporation, Municipal Council, or Nagar Panchyat. Also, write down the ward and block number related to your property.

- Provide the identity number of the property or house number, followed by the name of the colony or mohalla where your property is located.

- Select the type of property as either residential or non-residential. Specify the status of your property as self-occupied or other than self-occupied. If applicable, ensure to mention both statuses.

- Enter the owner's details, including their full name, father's name, sex, date of birth or age, and upload one form of identity proof.

- Provide the area of the plot in square yards. If your building is multi-story or multiuse, complete Annexure -8A.

- Complete the total covered area of the building by providing the area for each floor. If there are additional floors, use another sheet for extra entries.

- Proceed to Part B if applicable, to detail any exemptions based on the specified categories. Attach supporting documentation for any claims.

- For Part C, follow the instructions pertaining to residential buildings with a plot area of up to 100 square yards and a built-up area of 900 square feet.

- In Part D, if the property is rented, provide the total annual rent and the name of the tenant. Attach proof of the rental agreement.

- Continue with Part E, where you need to determine the market value as defined and calculate the total cost of construction.

- Complete the calculations in Part F to determine any exemptions, total payable tax, and any applicable penalties.

- Finally, review all the filled information, save your changes, and if necessary, download, print, or share the completed form.

Ensure your property tax is correctly assessed by completing the Self Assessment Form online today.

If you don't file your return and pay any tax due on time, you'll face fines and there are potential extra penalties. So don't delay submit before the deadline and pay any tax you owe with whatever information you have available even if you need to subsequently amend your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.