Loading

Get Pc-286 - Connecticut Probate Courts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PC-286 - Connecticut Probate Courts online

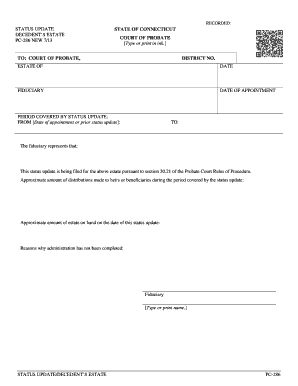

Filling out the PC-286 form is an essential part of the probate process in Connecticut. This guide provides a clear, step-by-step approach to help you navigate each section of the form online with ease.

Follow the steps to complete the PC-286 form efficiently.

- Click the ‘Get Form’ button to obtain the PC-286 form and open it in your preferred editor.

- Fill in the 'TO' section with the appropriate court of probate to which you are submitting the update. Ensure you include the district number for accuracy.

- Under 'ESTATE OF,' indicate the name of the decedent whose estate is being updated.

- Record the date of filling out the form in the 'DATE' field.

- Complete the 'FIDUCIARY' section by entering your name as the fiduciary responsible for the estate.

- In the 'DATE OF APPOINTMENT' field, provide the date you were appointed as fiduciary.

- Indicate the period covered by the status update by filling in the 'FROM' and 'TO' dates. The 'FROM' date should reflect either the date of your appointment or the date of the prior status update.

- In the section regarding distributions, estimate the 'Approximate amount of distributions made to heirs or beneficiaries during the period covered by the status update.'

- Provide the 'Approximate amount of estate on hand on the date of this status update' to illustrate the current status of the estate.

- Explain the 'Reasons why administration has not been completed' to give context to the status update.

- In the 'FIDUCIARY' section at the end, type or print your name to certify your completion of the form.

- After completing the form, save your changes. You can also choose to download, print, or share the completed PC-286 form as needed.

Complete your form online today for a smoother probate process.

However, there is no longer a cap on the probate fee for estates over $4,754,000. Estates totaling $2,000,000 and over will now pay $5,615 plus . 5% of all in excess of $2,000,000. For example, a $10 million estate will now incur a fee of $45,615 under this new schedule.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.