Loading

Get Promissory Note (forgivable Loan) - S3.amazonaws.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

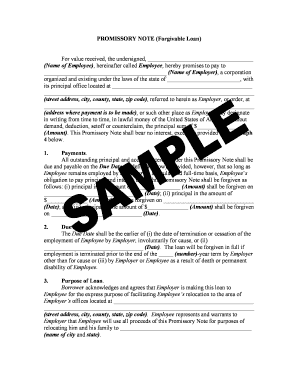

How to fill out the PROMISSORY NOTE (Forgivable Loan) - S3.amazonaws.com online

Filling out a promissory note can be a straightforward process when you have clear guidance. This guide assists you in completing the PROMISSORY NOTE (Forgivable Loan) form, ensuring you understand each section and can provide the necessary information accurately.

Follow the steps to complete your form effectively.

- Use the 'Get Form' button to retrieve the form and open it in your preferred online editor.

- Begin by entering the name of the employee in the designated field. This should be the person who is receiving the loan.

- Next, fill out the name of the employer. This is the organization providing the loan, so ensure the company’s full name is included.

- Input the state in which the employer is organized legally. This is crucial to establish jurisdiction.

- Provide the complete street address, including city, county, state, and zip code of the employer's principal office.

- Specify the amount being loaned in the principal sum field. This is the total amount of money the employee is borrowing.

- Mention the designated payment address for where the employee will make loan payments, which may differ from the employer's principal office.

- Detail the amounts to be forgiven and the corresponding dates in the payments section. This outlines how much of the loan will be forgiven over time.

- Indicate the due date of the loan. This is either the date when employment ends or a specific future date as agreed upon.

- In the purpose of the loan section, make a statement about the reason for the loan, specifically for relocation purposes.

- Include any relevant terms under the default section regarding late payments and penalties that may occur.

- Complete the miscellaneous section by confirming any waivers of rights as they pertain to the obligations of both employee and employer.

- Ensure the date of execution is noted at the end of the document, alongside the employee's printed name and signature.

- After completing all fields, save your changes, and choose to download, print, or share the completed form as necessary.

Start completing your forms online now to ensure your loan process goes smoothly.

In the housing industry, a forgivable loan is a type of second mortgage. You don't have to pay this type of loan back unless you move before your loan term ends. These loans usually come with an interest rate of 0%, so it could be an excellent solution for lower-income homebuyers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.