Loading

Get Cert-120

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CERT-120 online

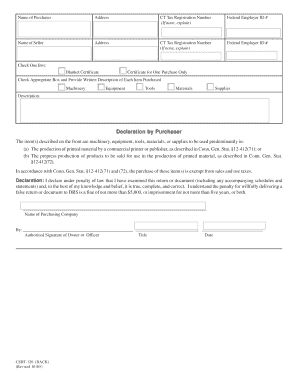

The CERT-120 is an essential document used for establishing tax exemption on machinery, equipment, tools, materials, and supplies utilized in the production of printed materials or in prepress production. This guide provides clear, step-by-step instructions to assist users in completing this form accurately and efficiently.

Follow the steps to complete the CERT-120 online.

- Click ‘Get Form’ button to access the CERT-120 and open it in your preferred online editor.

- Fill in the 'Name of Purchaser' section with your organization's name. Ensure that you enter the name exactly as it appears on your business records.

- Provide the 'Address' for the purchaser, making sure that all details are correct for correspondence.

- If applicable, enter the 'CT Tax Registration Number.' If you do not have one, explain by mentioning the registration number provided by another state along with its identification.

- Enter the 'Federal Employer ID #' if your organization has one; otherwise, leave this field blank if not applicable.

- Complete the 'Name of Seller' and 'Address' sections for the seller of the items, ensuring all information is accurate.

- Fill in the seller's 'CT Tax Registration Number' and 'Federal Employer ID #,' providing explanations as needed.

- Choose between 'Blanket Certificate' and 'Certificate for One Purchase Only' by checking the appropriate box.

- Check the appropriate box for the type of items purchased (Machinery, Equipment, Tools, Materials, Supplies) and provide a written description for each item.

- Review the 'Declaration by Purchaser' section. Confirm the items will be used predominantly in the production of printed material or prepress production.

- Sign the document in the 'Authorized Signature of Owner or Officer' section, along with your title and the date.

- Once completed, you can save changes, download, print, or share the CERT-120 as needed.

Complete your documents online today for seamless processing.

To claim exemption for the purchase of goods or taxable services, the organization must complete CERT-119, Certificate for Purchases of Tangible Personal Property and Services by Qualifying Exempt Organizations and give it to the retailer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.