Loading

Get Life Insurance Replacement Declaration-effective April 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Life Insurance Replacement Declaration-effective April 1 online

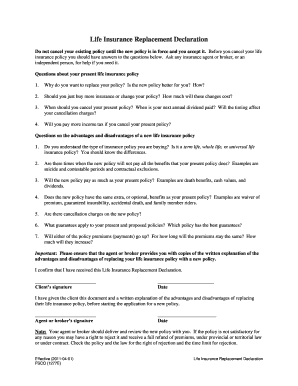

The Life Insurance Replacement Declaration is an essential document for anyone considering replacing their current life insurance policy. This guide will provide you with step-by-step instructions on how to complete this declaration online, ensuring that you have all the necessary information at hand.

Follow the steps to fill out the Life Insurance Replacement Declaration online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by reading the introductory section, which highlights the importance of not canceling your current policy until your new policy is fully effective.

- In the first section, answer the questions about your present life insurance policy. Consider why you are looking to replace your policy and if a new policy is indeed a better option for you.

- Reflect on whether it is more beneficial to buy additional insurance or make adjustments to your current policy. Use this space to calculate potential costs of these changes.

- Evaluate the timing for canceling your current policy. Note any relevant dates, such as when your next annual dividend is due, to assess the possible impact on cancellation fees.

- Consider any income tax implications that may arise from canceling your existing policy, and seek advice if needed.

- Address the questions related to the new life insurance policy. Confirm your understanding of the type of new policy you are purchasing, whether it is term life, whole life, or universal life.

- Compare the benefits of the new policy with those of your current policy, and identify any potential exclusions or differences in the coverage provided.

- Document whether the new policy offers the same optional benefits as your current policy, checking for features like waiver of premium and accidental death riders.

- Assess any cancellation charges associated with the new policy and investigate the guarantees offered by both your current and new policies.

- Lastly, fill in the signature fields. The client should sign and date the form, and the agent or broker should provide their signature and date as well.

- Once completed, save your changes. You can download, print, or share the form as needed.

Take action now and complete your Life Insurance Replacement Declaration online to ensure a smooth transition to your new policy.

The Life Insurance Replacement Declaration (LIRD) allows consumers to better consider the merits of replacing an existing life insurance policy, as the form sets out a number of important questions that the consumer may wish to consider when making their decision.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.