Loading

Get Conveyance Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Conveyance Tax Return online

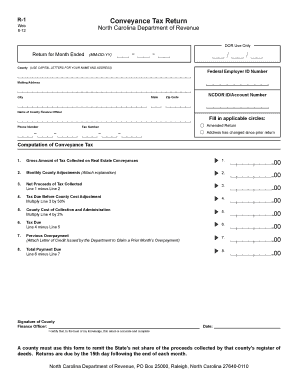

Filling out the Conveyance Tax Return online is an essential process for counties in North Carolina to report tax collected from real estate transactions. This guide will support you in completing the form efficiently and accurately.

Follow the steps to fill out the Conveyance Tax Return online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the return month and year in the designated area labeled 'Return for Month Ended (MM-DD-YY)'. Ensure to use the correct format.

- In the 'County' field, write the name of your county using capital letters. This should reflect the official name for accurate identification.

- Fill in the 'Federal Employer ID Number' and 'NCDOR ID/Account Number' to properly identify your account.

- Provide the 'Mailing Address', 'City', 'State', and 'Zip Code' for correspondence purposes.

- List the 'Name of County Finance Officer' and contact details such as 'Phone Number' and 'Fax Number', if applicable.

- Indicate if this is an 'Amended Return' by marking the applicable circle, along with checking if the address has changed since the last return.

- Proceed to the 'Computation of Conveyance Tax' section. Start with line 1; enter the 'Gross Amount of Tax Collected on Real Estate Conveyances'.

- On line 2, enter any 'Monthly County Adjustments'. Remember to attach an explanation if adjustments are made.

- Calculate the 'Net Proceeds of Tax Collected' on line 3 by subtracting line 2 from line 1.

- For line 4, multiply the value from line 3 by 50% to determine the 'Tax Due Before County Cost Adjustment'.

- On line 5, calculate the 'County Cost of Collection and Administration' by multiplying line 4 by 2%.

- Compute the 'Tax Due' on line 6 by subtracting line 5 from line 4.

- If claiming a previous overpayment, attach a Letter of Credit and input the amount on line 7.

- Determine the 'Total Payment Due' on line 8 by subtracting line 7 from line 6.

- Finalize your form by signing as the County Finance Officer, providing the date, and certifying the accuracy of the return.

- Once completed, save your changes, and review your inputs. You can download, print, or share the form as needed.

Complete your Conveyance Tax Return online today to ensure compliance and timely submission.

This tax, typically paid by the seller at closing, is based on a percentage of the total sales price of a home. Sellers in some states pay multiple conveyance taxes, one to the state and another to the town and/or county. In Connecticut, sellers pay a state conveyance tax along with a municipal tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.