Loading

Get Form X-nol - Wisconsin Department Of Revenue - Revenue Wi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form X-NOL - Wisconsin Department Of Revenue - Revenue Wi online

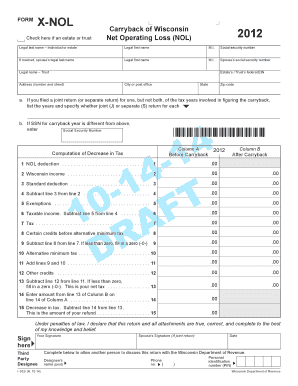

Filling out the Form X-NOL is an essential step for individuals or estates seeking to carry back a Wisconsin net operating loss. This guide provides detailed, straightforward instructions to help users complete the form online with confidence.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the document and open it for editing.

- Begin by entering your legal last name, first name, and middle initial in the designated fields.

- Input your social security number in the field provided.

- If applicable, fill in your spouse’s legal last name, first name, middle initial, and social security number.

- If this form pertains to a trust, input the legal name of the trust and the estate’s or trust's federal EIN.

- Complete your address including street number, city or post office, state, and zip code.

- If you filed a joint return or separate returns for the relevant tax years, specify the years and indicate whether each was a joint (J) or separate (S) return.

- Follow the calculations for standard deductions, exemptions, taxable income, tax amount, credits, and net tax by entering the appropriate figures in the designated lines.

- Carefully review all entries for accuracy.

- At the conclusion of your entries, save your changes, and then download, print, or share the completed form as needed.

Complete your forms online to ensure a smooth and efficient filing process.

Wisconsin modifications cannot create an NOL except adjustments from tax-option (S) corporations. Do I have to make a formal election when I want to claim the NOL carryback? No. Filing Form X-NOL, Carryback of Wisconsin Net Operating Loss (NOL), for the year of the carryback is all that is necessary.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.