Loading

Get Form St 5 See Rule 9 (1) Form Of Appeal To Appellate Tribunal ... - Webtel

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM ST 5 See Rule 9 (1) Form Of Appeal To Appellate Tribunal online

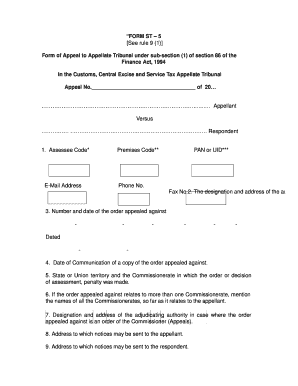

The FORM ST 5 is utilized for filing an appeal to the Appellate Tribunal under the provisions set forth in the Finance Act, 1994. This guide will provide you with a step-by-step approach to filling out the form correctly, ensuring you meet all required criteria.

Follow the steps to successfully complete your appeal form.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Fill in the 'Assessee Code' along with your email address, premises code, PAN or UID, phone number, and fax number. Ensure that all details are accurate to avoid delays.

- Provide the designation and address of the authority related to the order you are appealing against.

- Enter the number and date of the order you are appealing against. This information is essential for processing your appeal.

- Indicate the date you received communication of the order you are appealing against.

- Specify the state or Union territory and the Commissionerate where the order was made.

- If the order involves more than one Commissionerate, list all applicable names.

- Provide the address for notices to be sent to you, the appellant.

- Enter the address for notices to be sent to the respondent.

- State whether the order appeals involve any questions related to service tax rates or taxable service values.

- Describe the service involved and indicate if it falls under the 'negative list'.

- Mention the period of the dispute clearly to precisely indicate the duration involved.

- Fill in the amounts concerning service tax, interest, refund, and penalty associated with the dispute.

- If applicable, provide details on any service tax, penalty, or interest deposited, including a copy of the deposit challan.

- Indicate if the order involves any central excise duty demand, along with any related fines or penalties.

- Confirm if the order involves any customs duty demand and related penalties.

- Select the subject matter of the dispute in order of priority from the provided list.

- Provide your Central Excise Assessee Code if you are registered with Central Excise.

- Include details of your Importer Exporter Code (IEC) if you are registered with the Director General of Foreign Trade.

- If appealing against an Order-in-Appeal of the Commissioner, mention the number of Orders-in-Original covered.

- Indicate whether the respondent has filed an appeal against the same order.

- If yes, provide the details of that appeal.

- Specify if you wish to be heard in person regarding your appeal.

- State the reliefs you are seeking in your appeal, including a clear statement of facts and grounds for the appeal.

- Complete the verification section, confirming the accuracy of the information provided.

- Remember to sign the form both as the appellant and any authorized representative.

- Ensure that you save your changes, download the completed form, print it if necessary, or share it as required.

Complete your appeal document online today to ensure timely submission.

For taxpayers who are required to e-file the income tax return, e-appeal is to be mandatorily filed through . incometaxefiling. gov.in. The details of CIT(Appeals), before whom appeal can be filed by the aggrieved taxpayer can be found out in the notice of demand issued by the Assessing Officer under section 156.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.